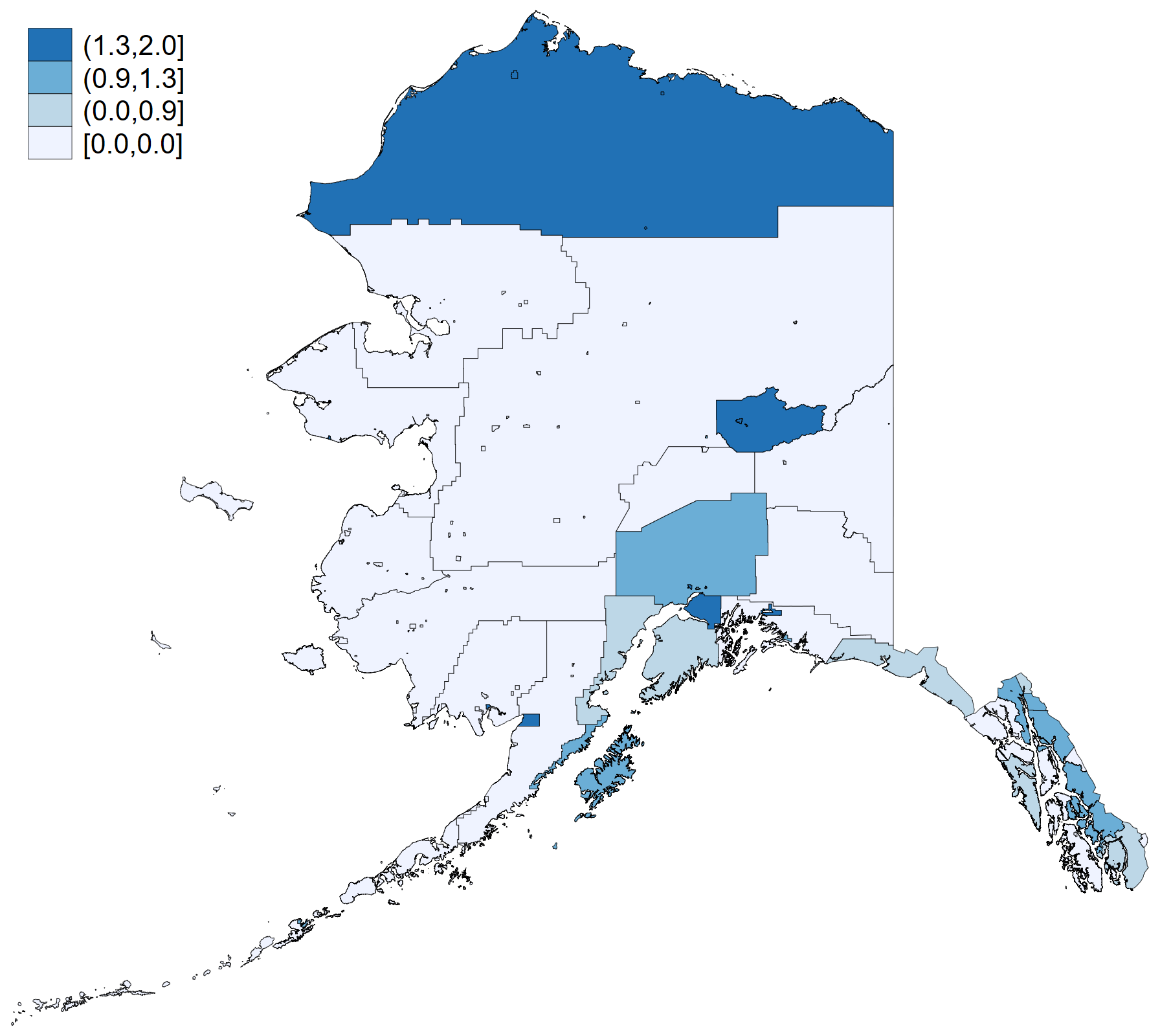

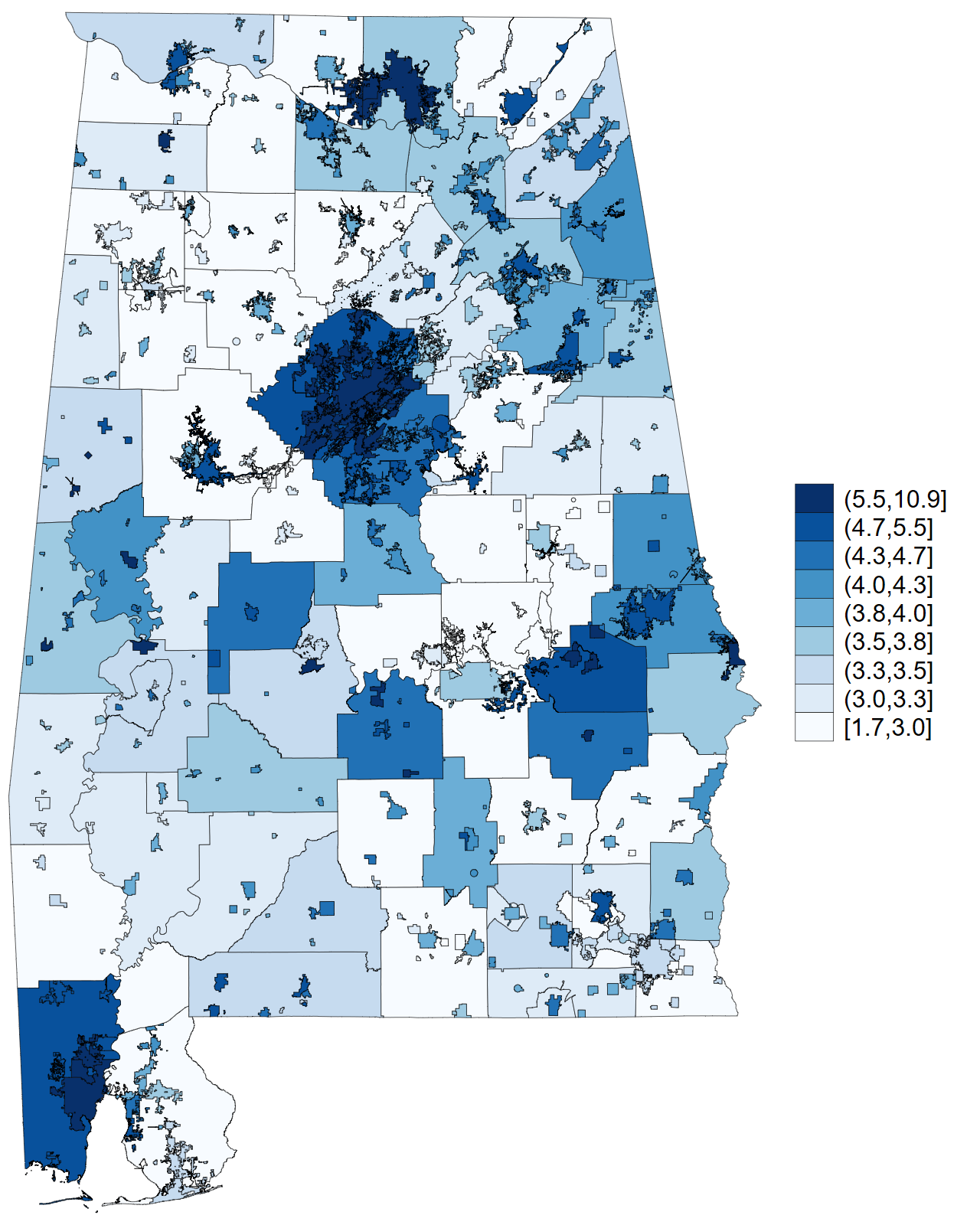

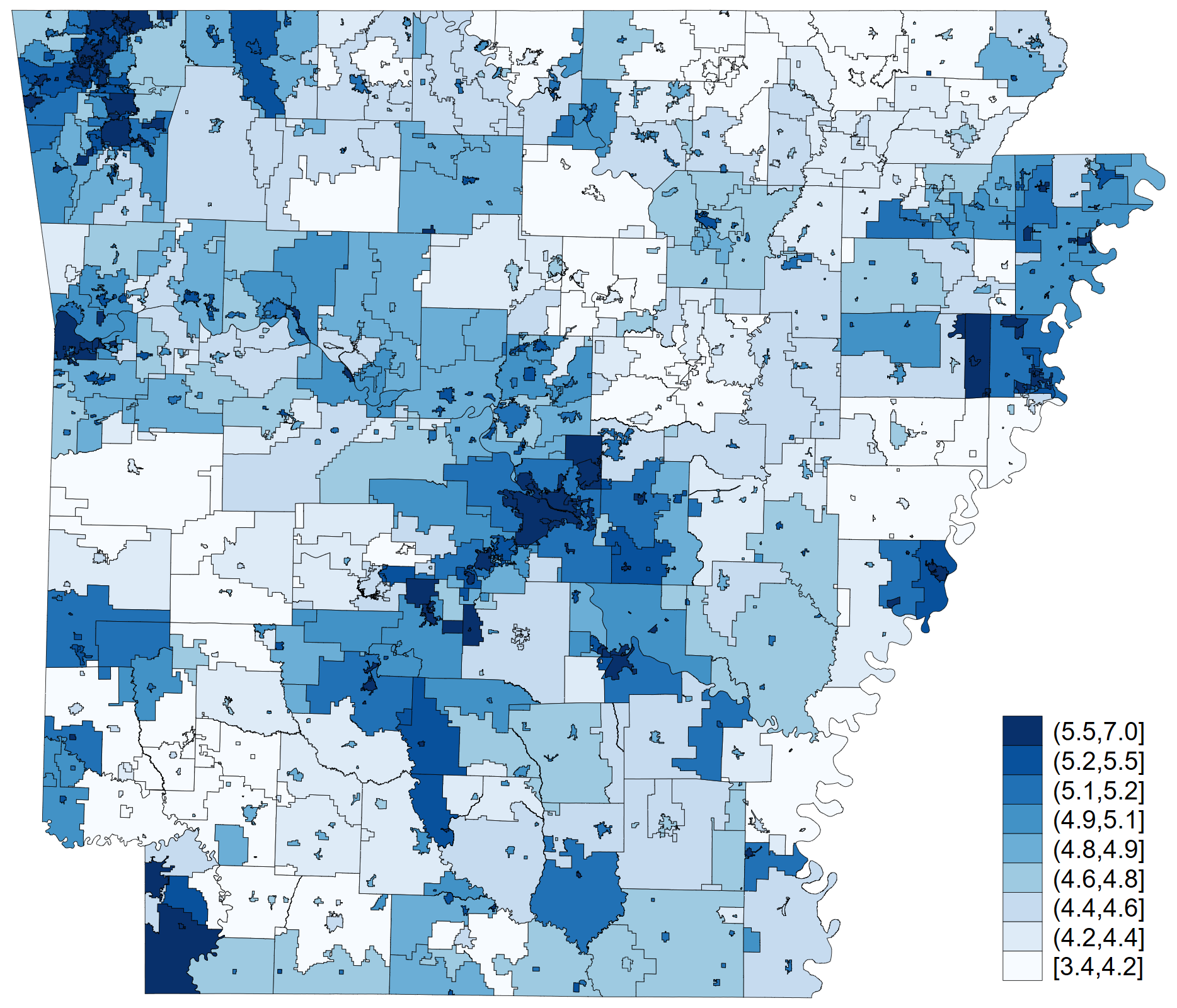

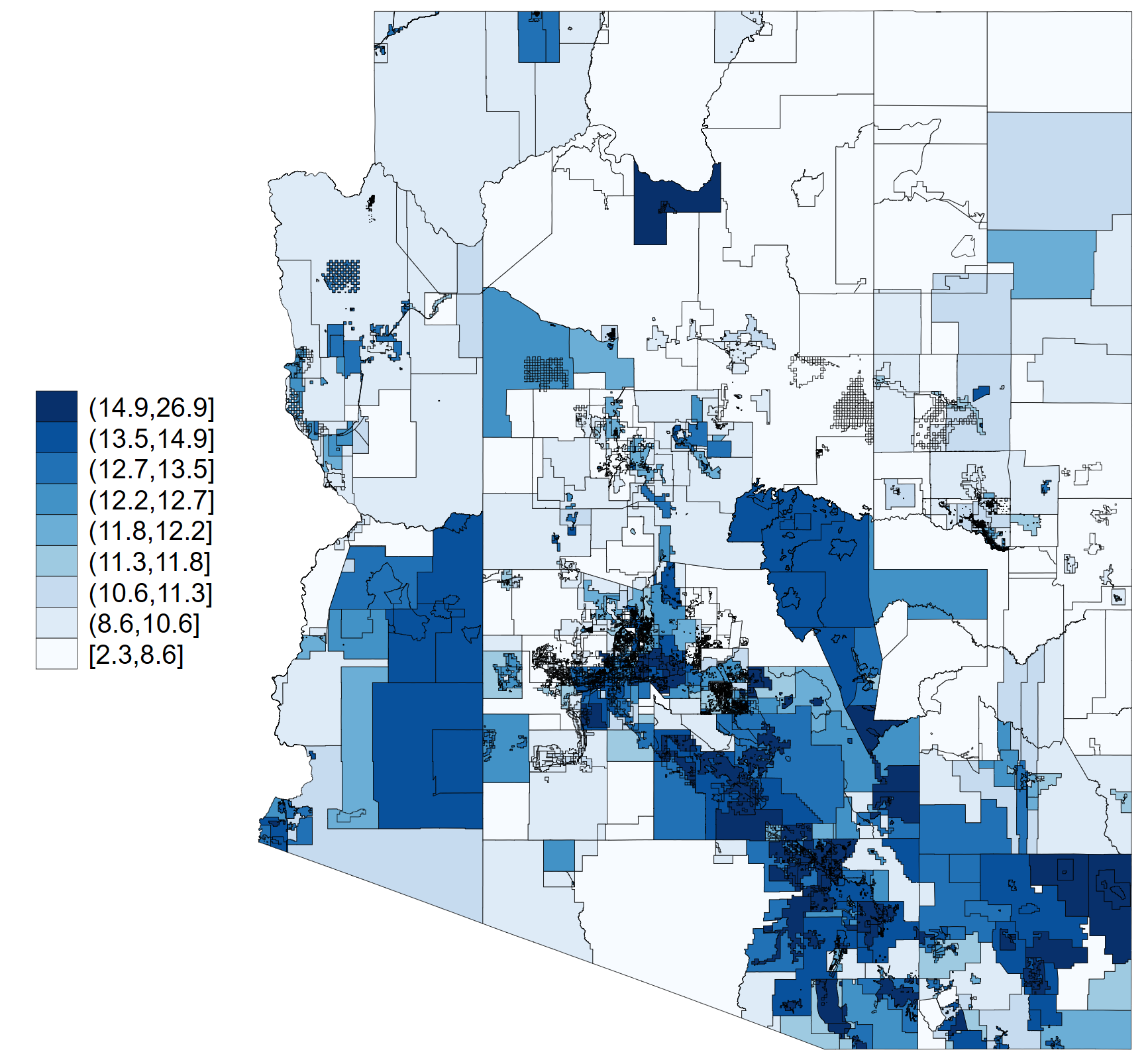

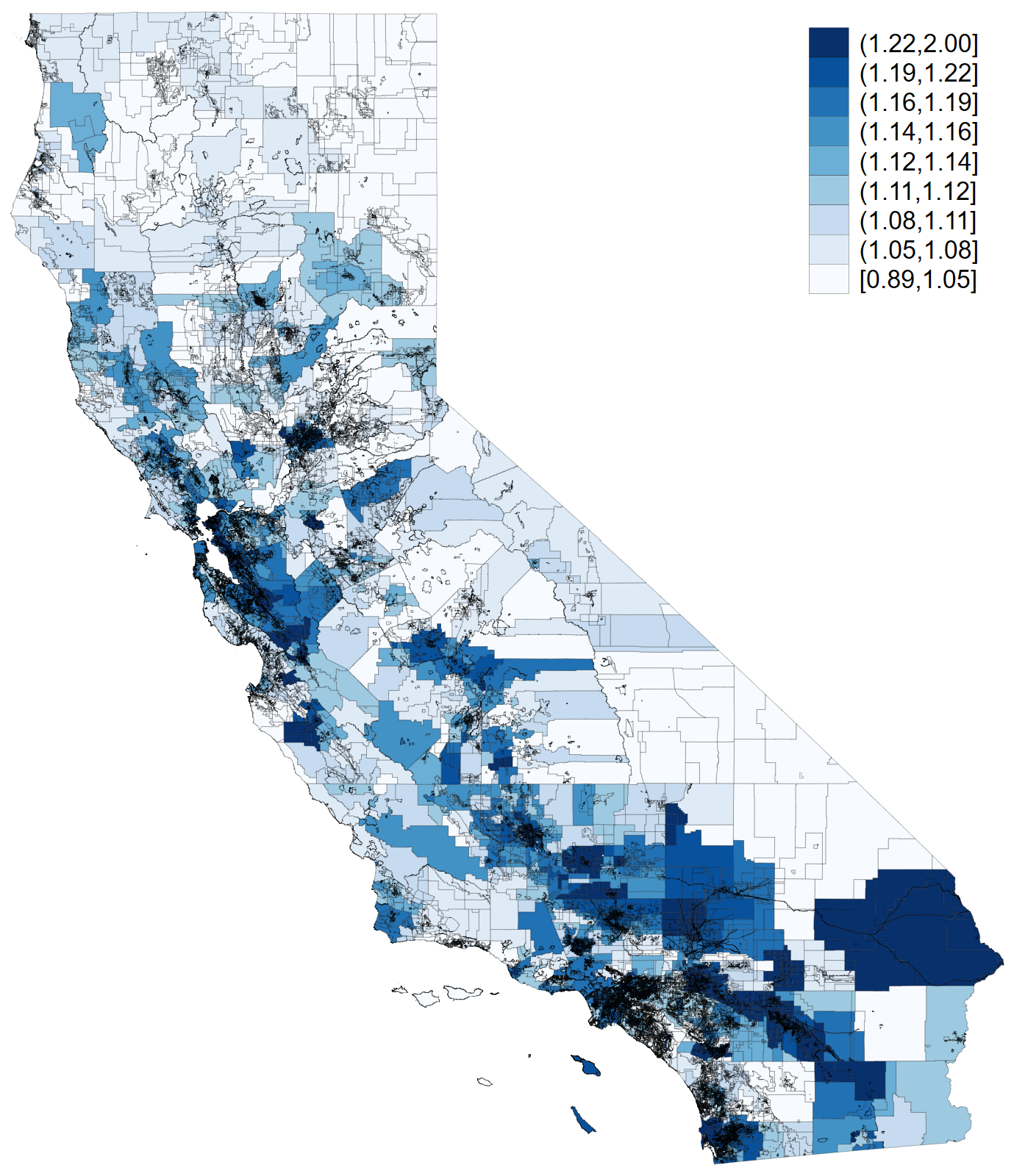

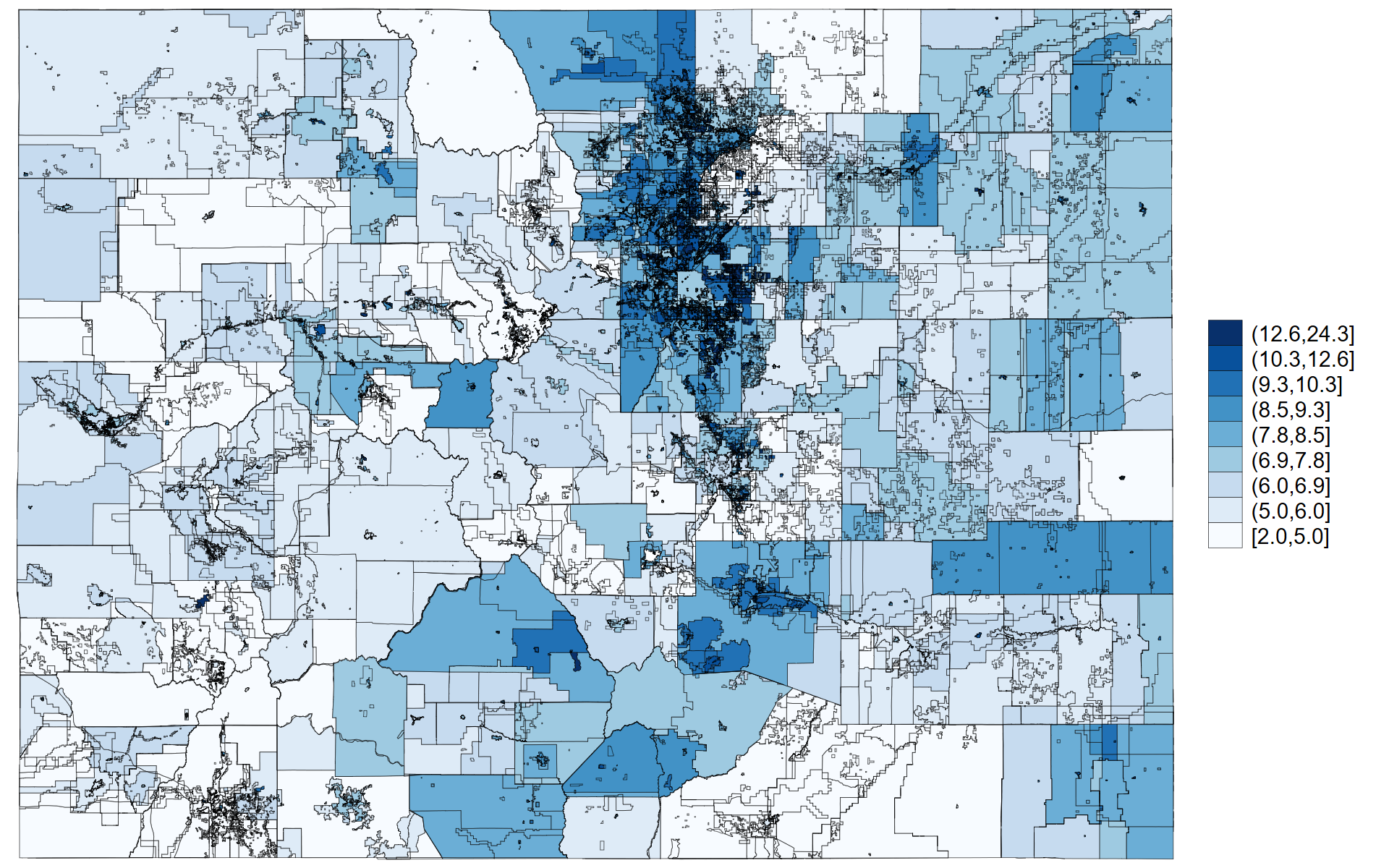

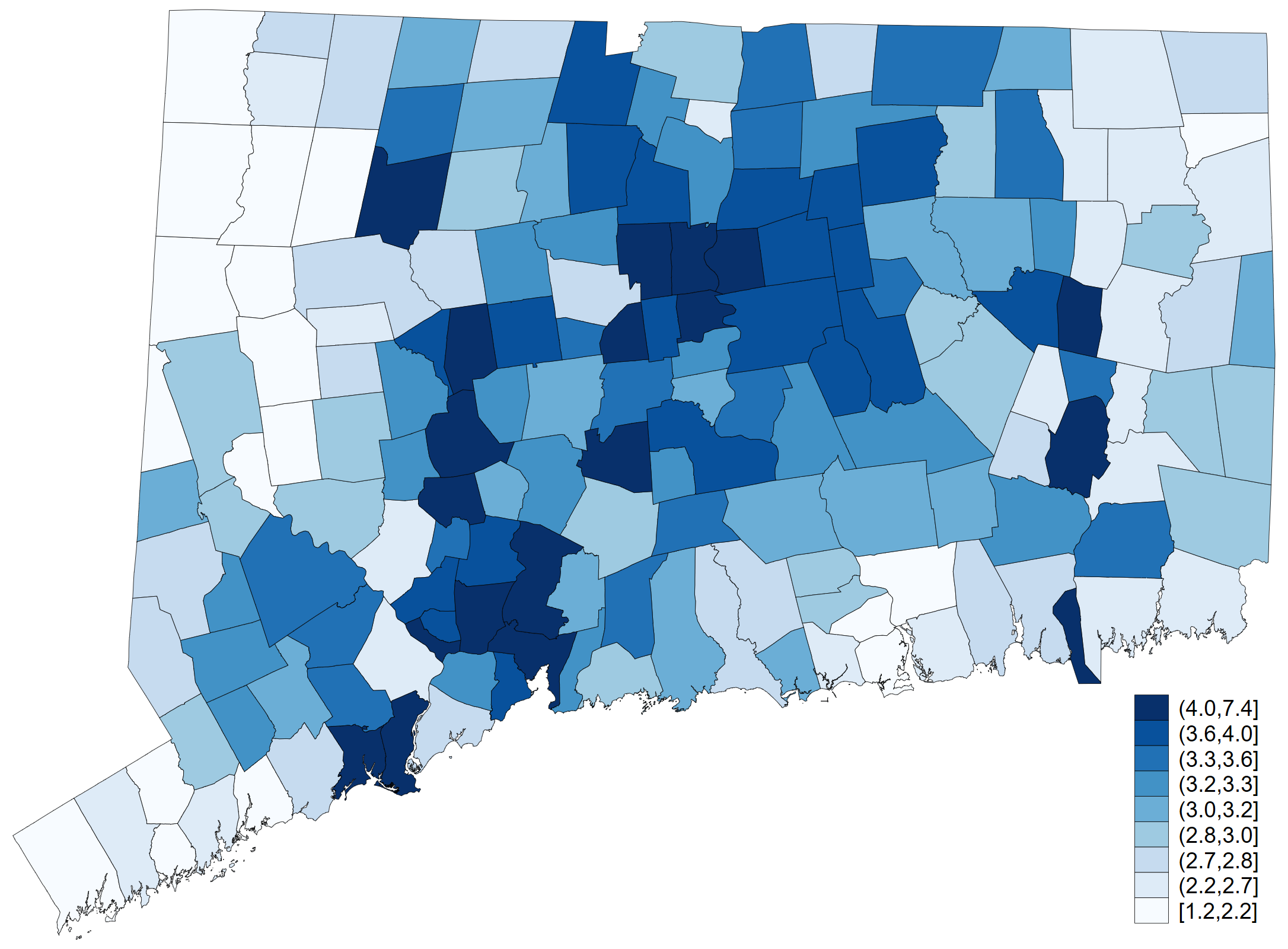

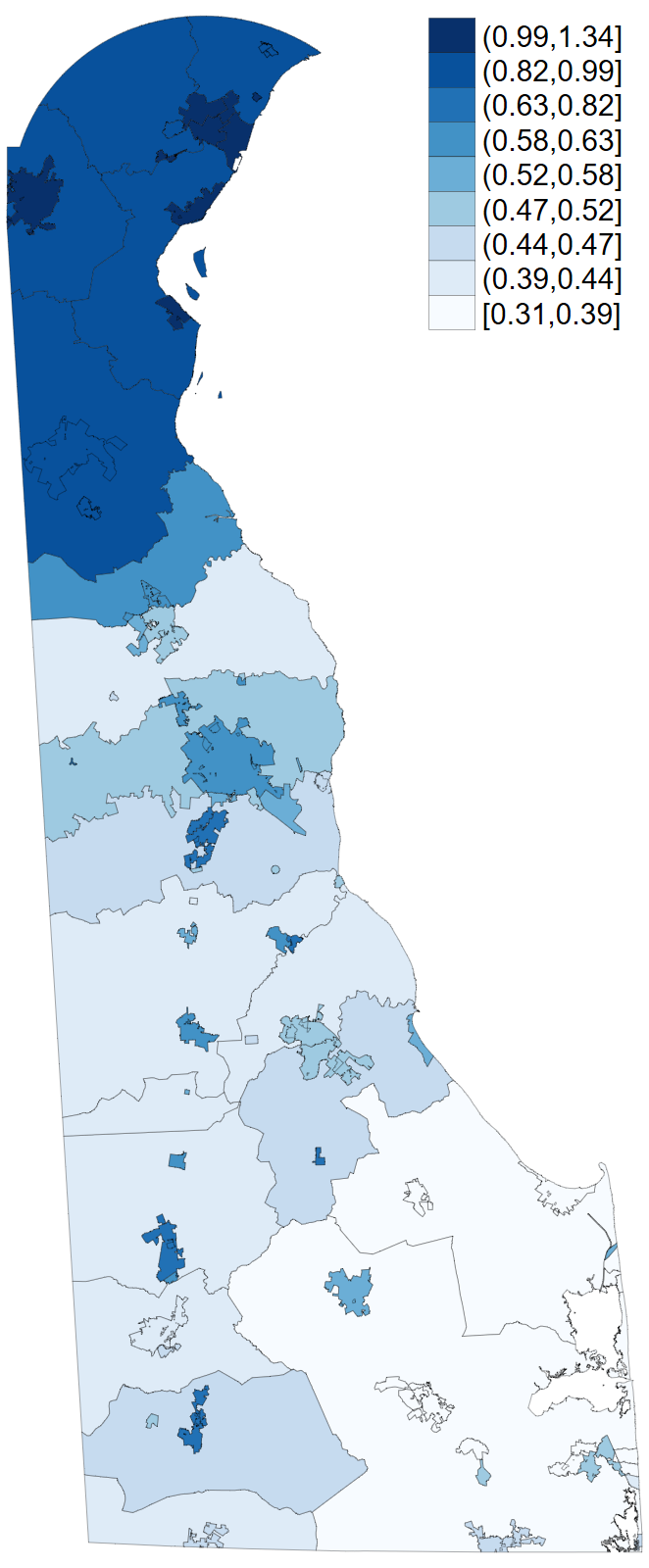

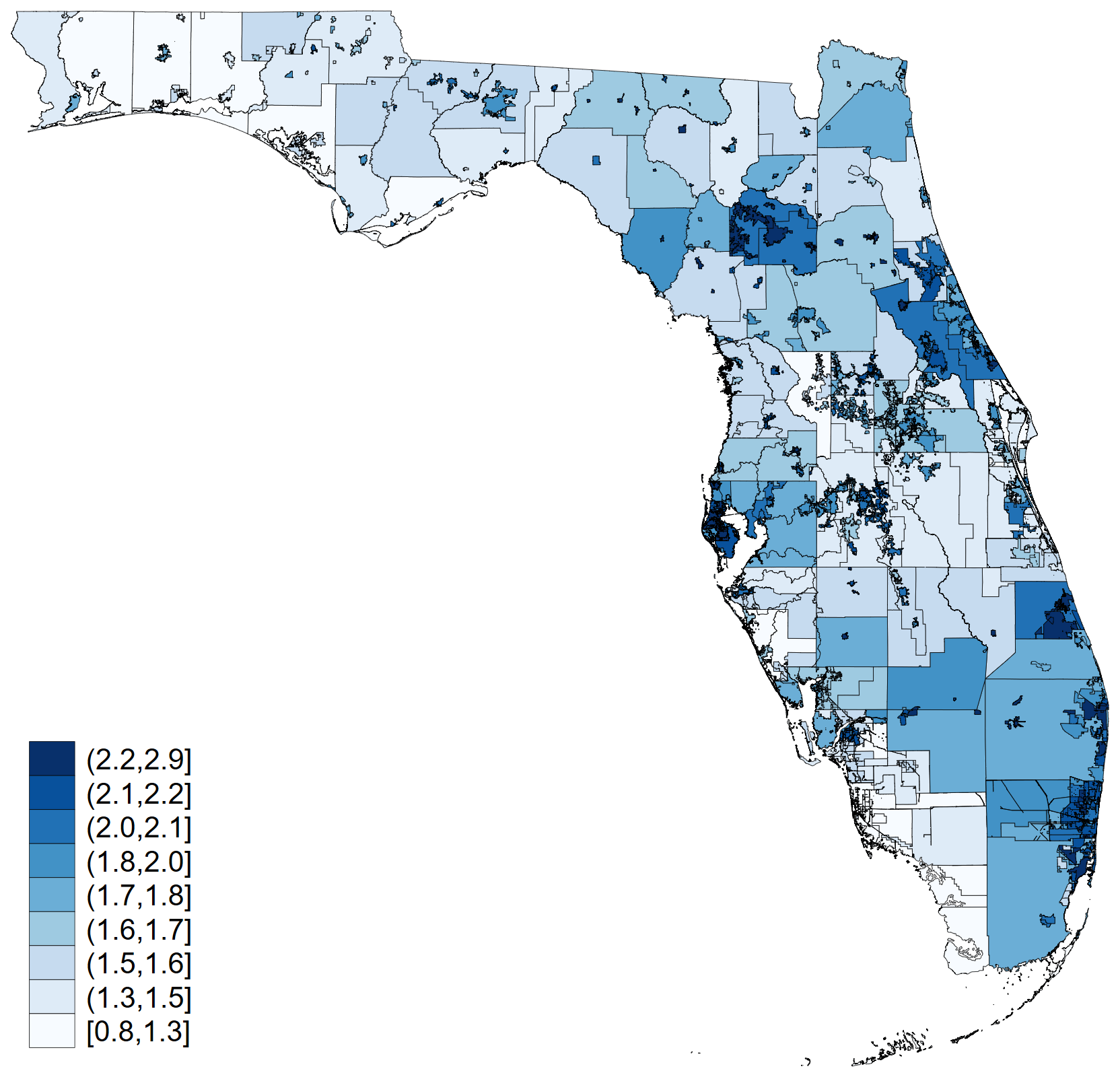

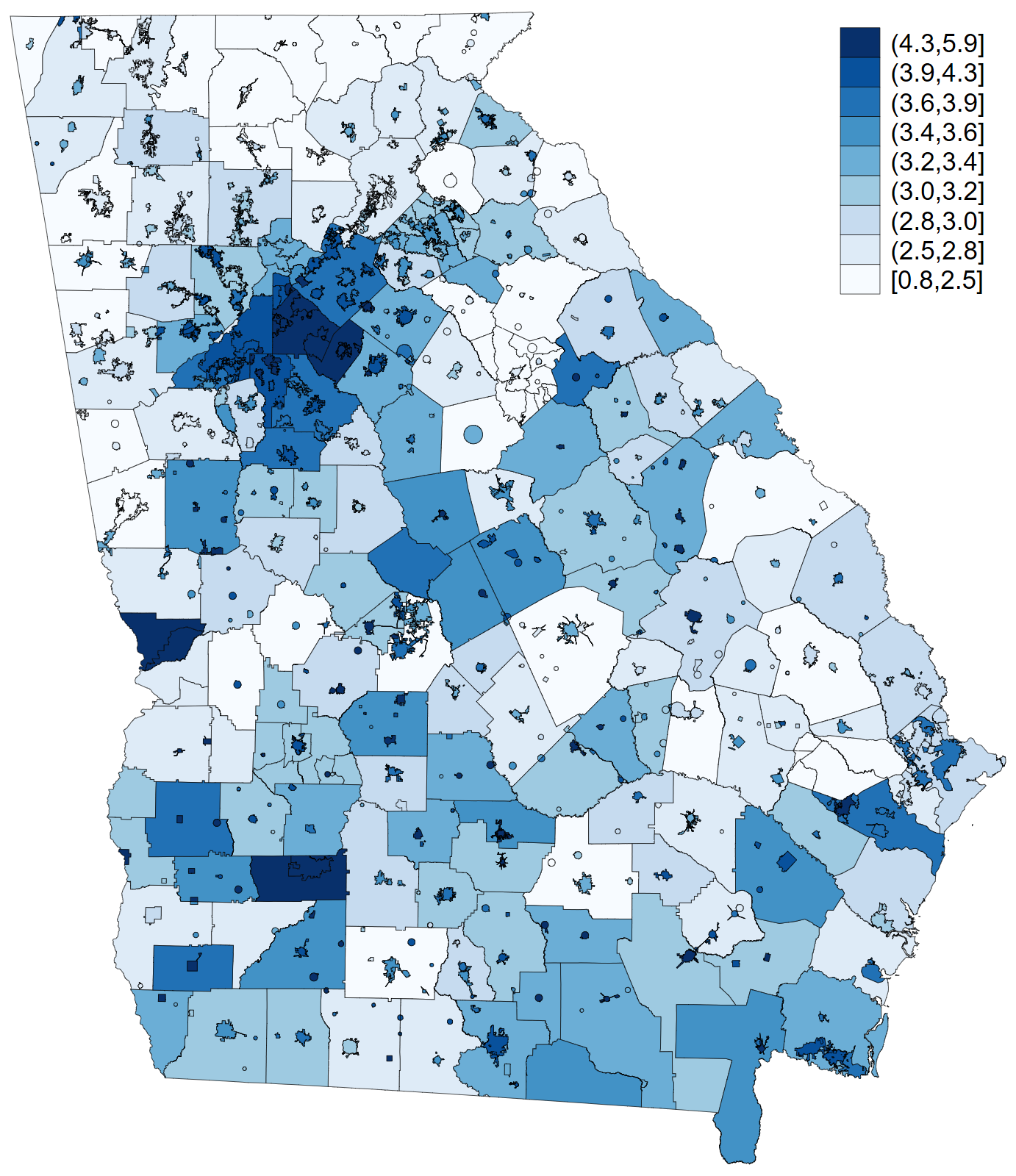

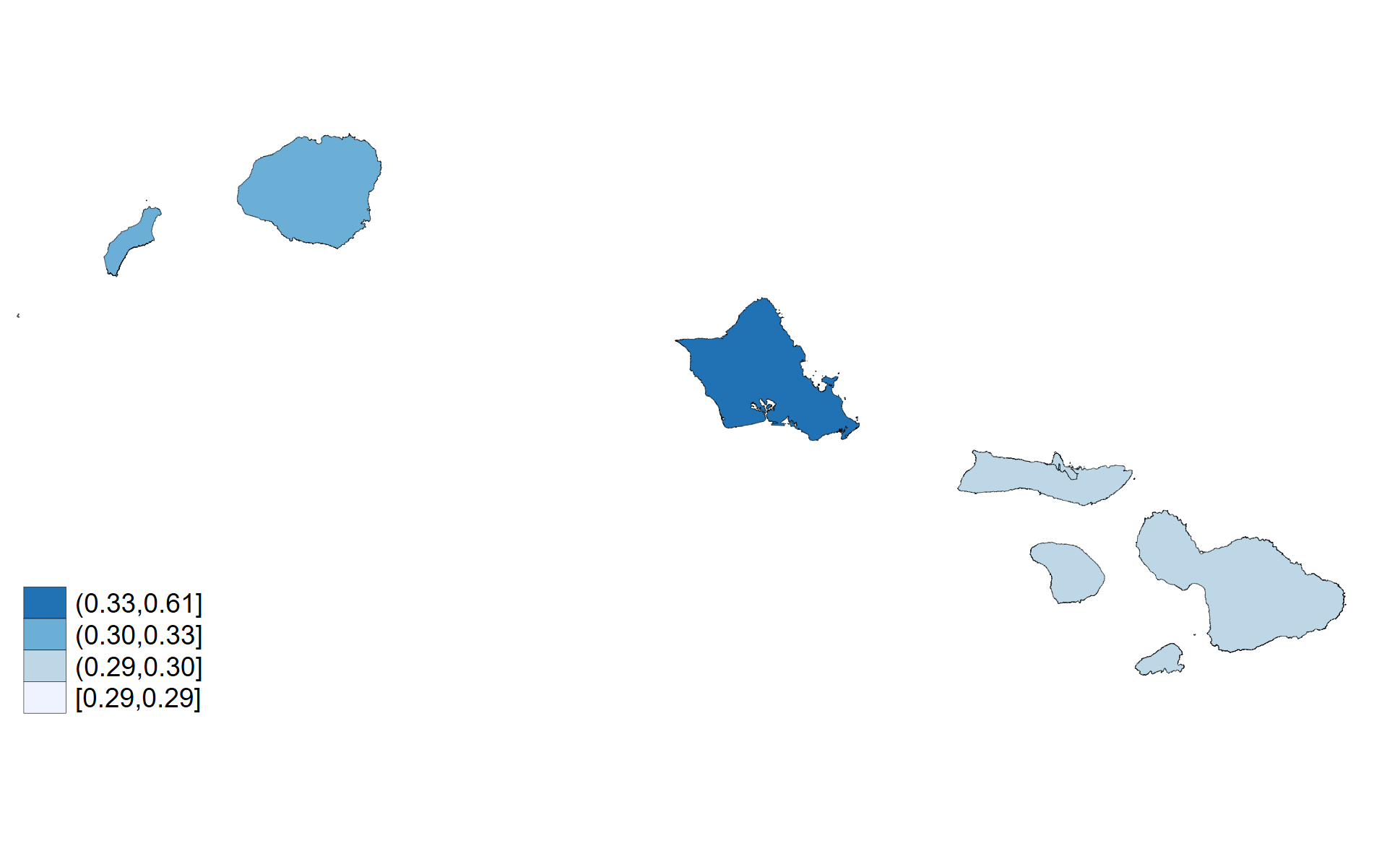

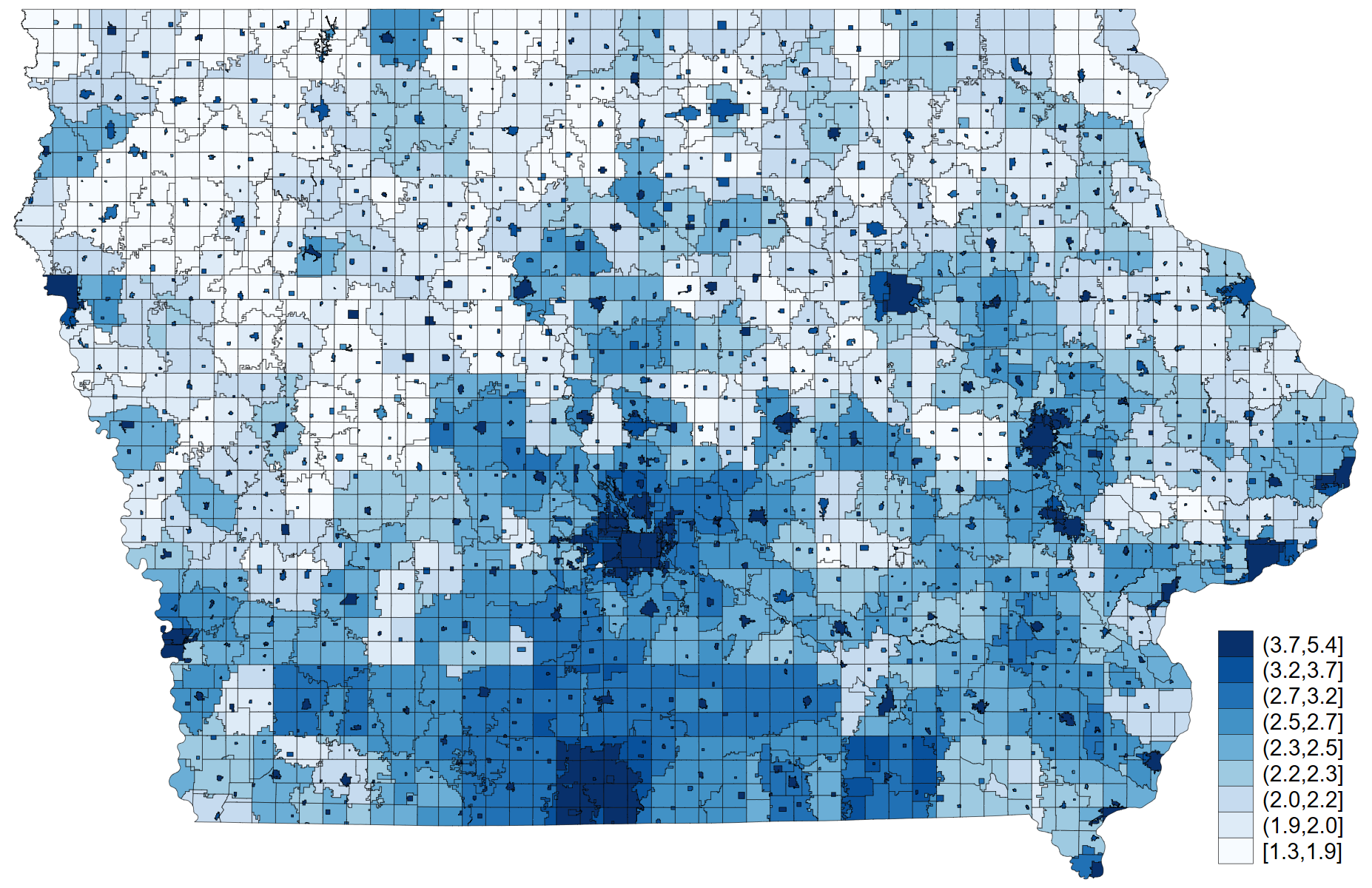

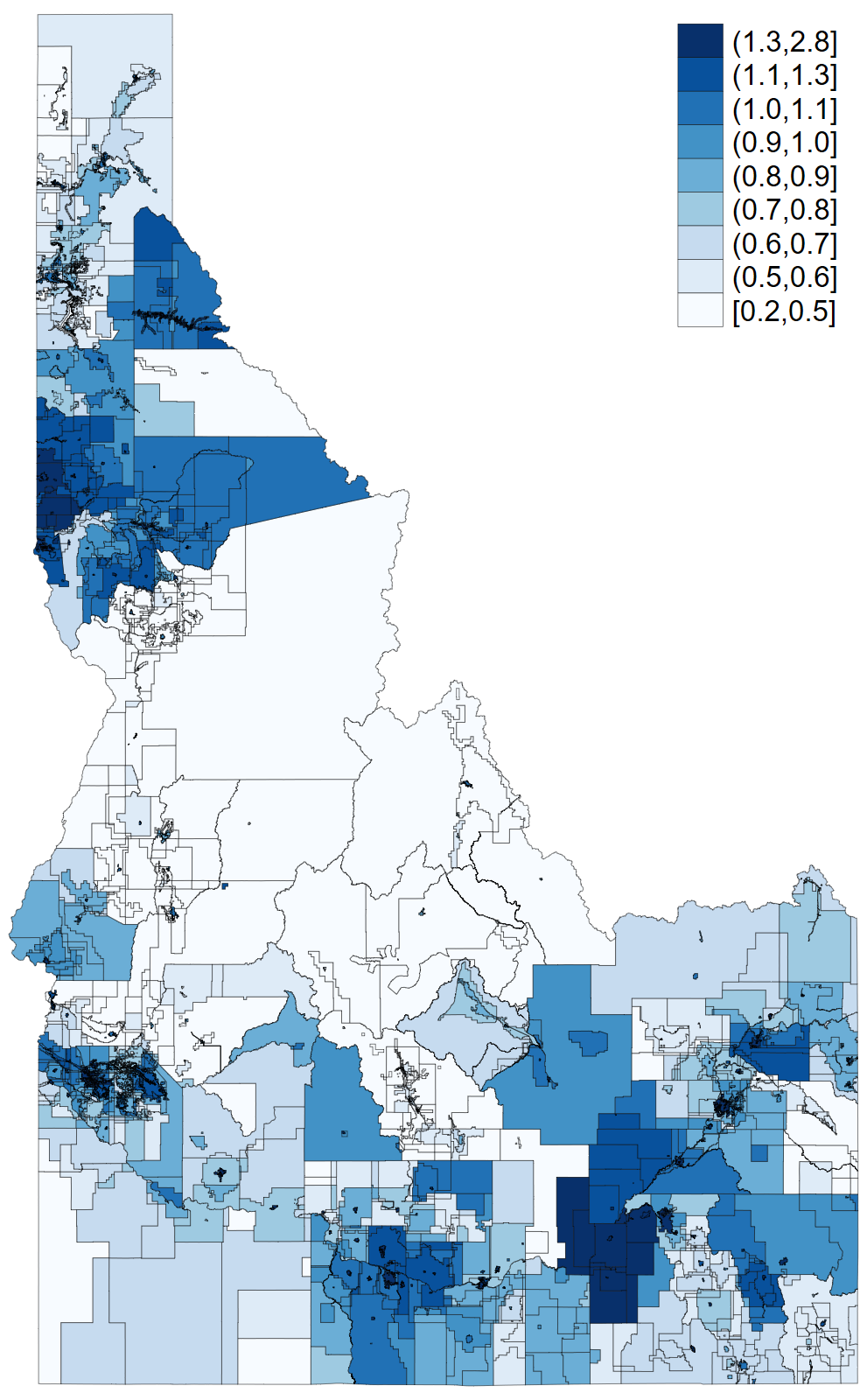

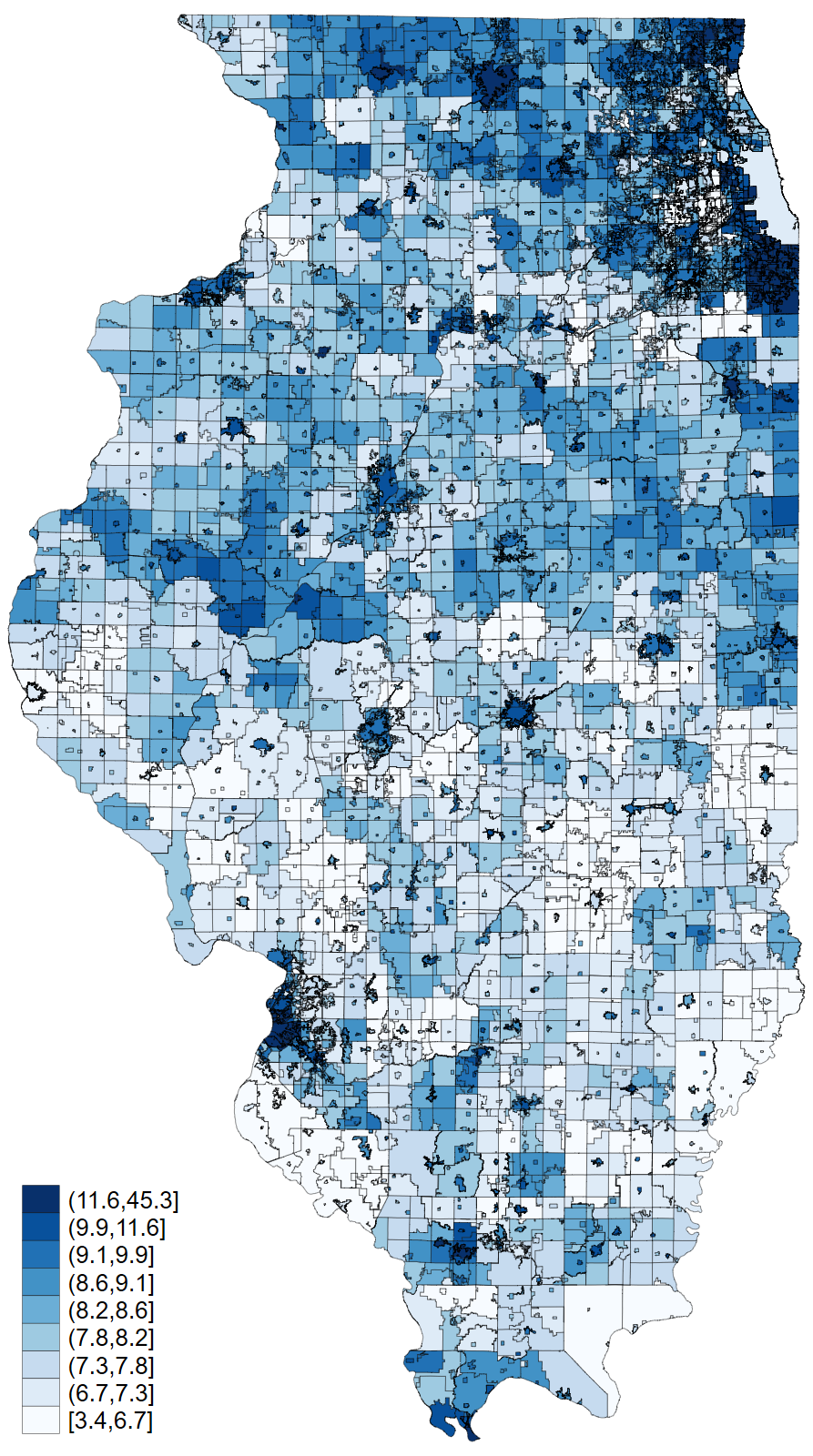

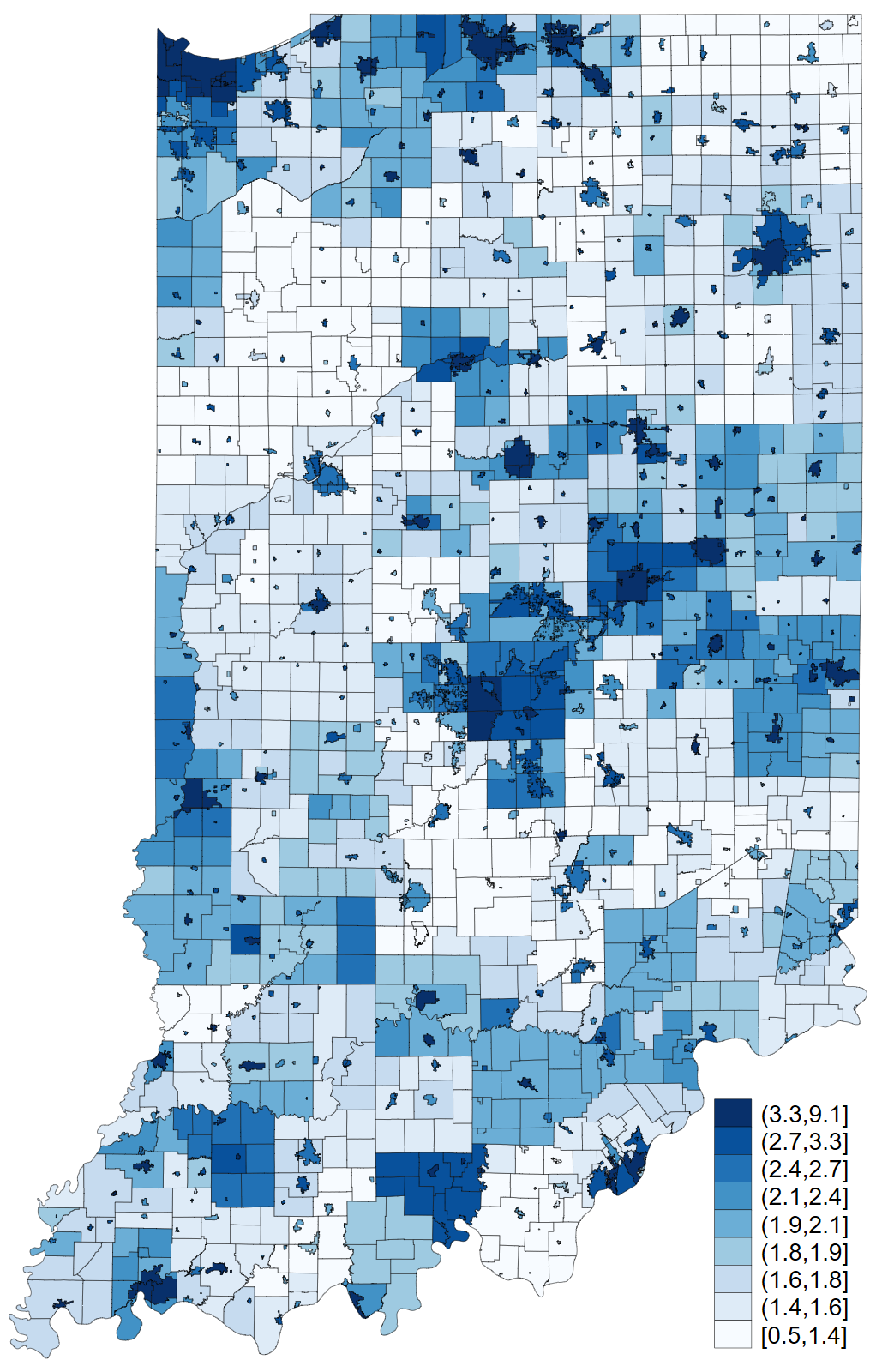

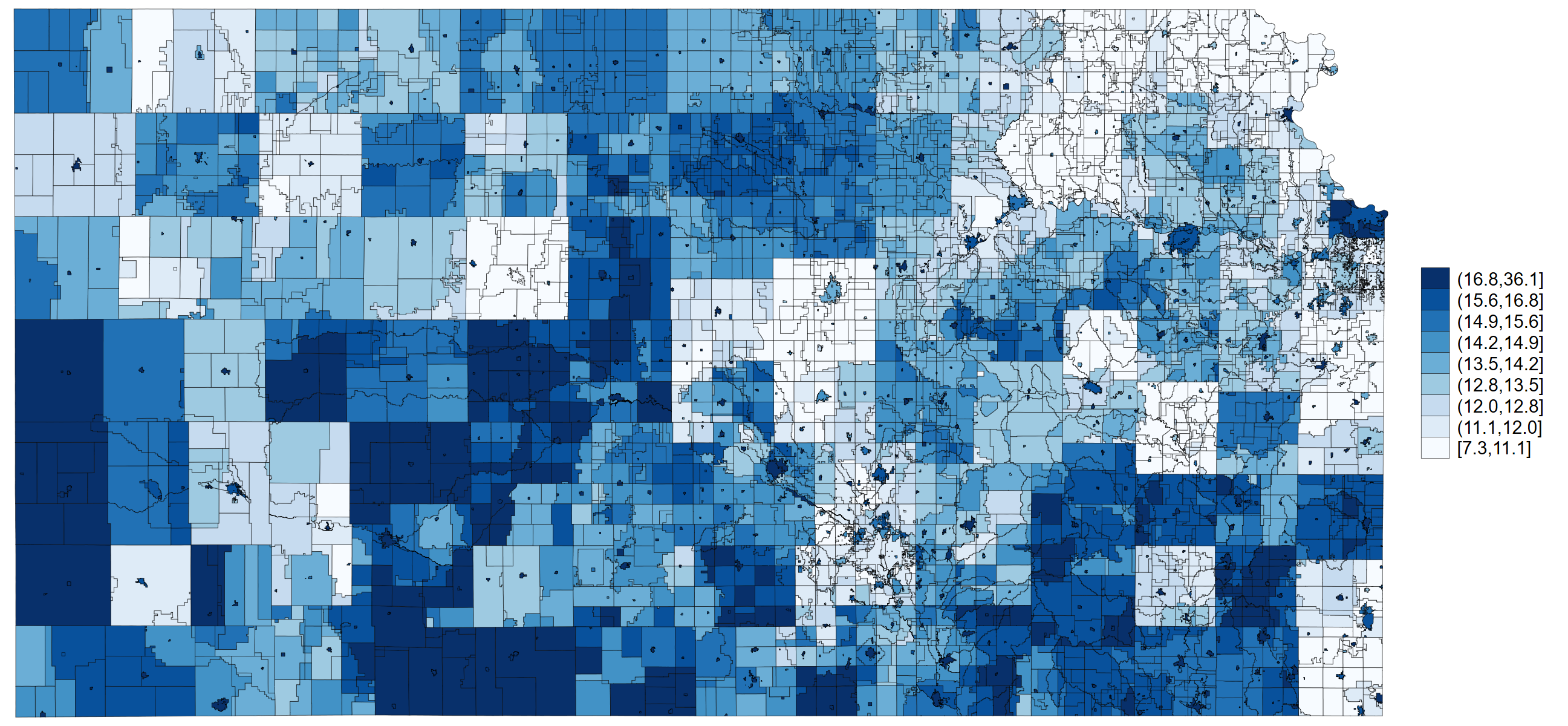

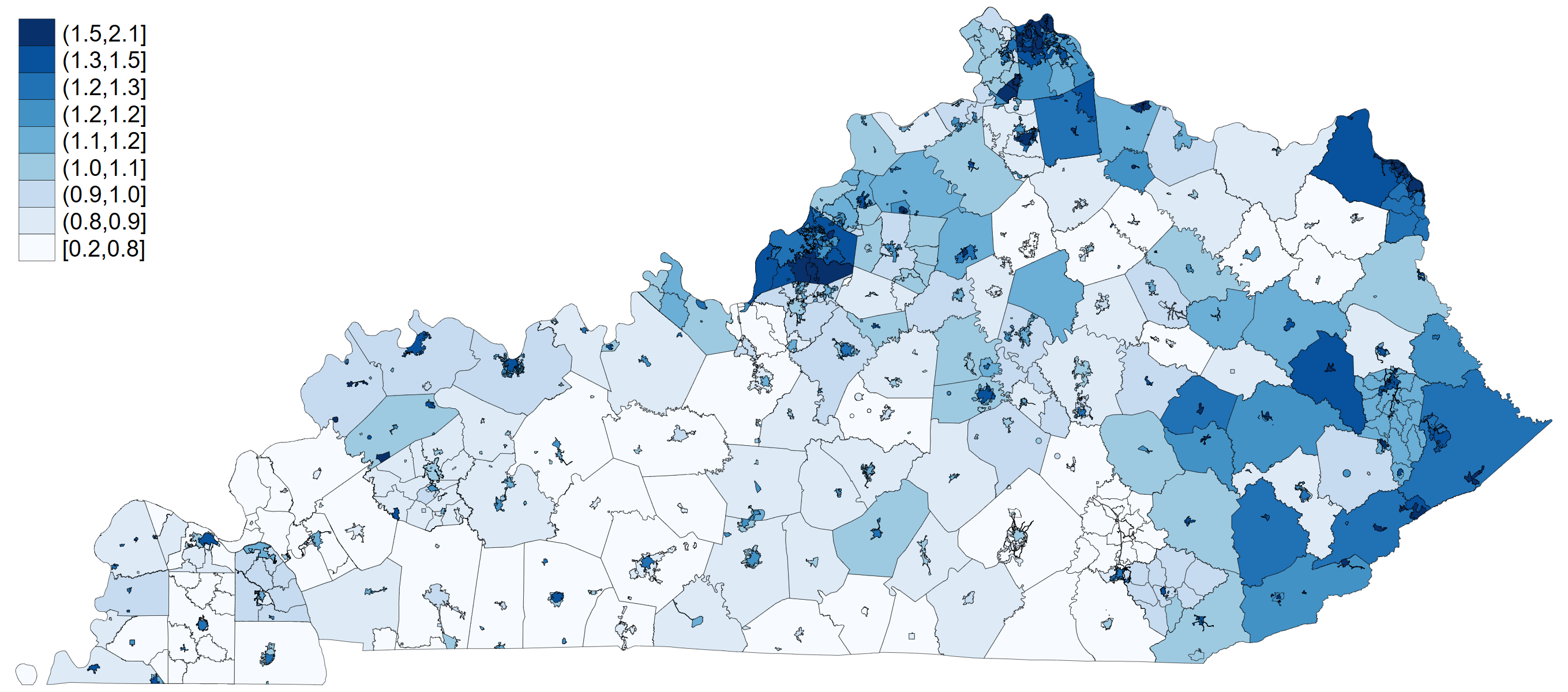

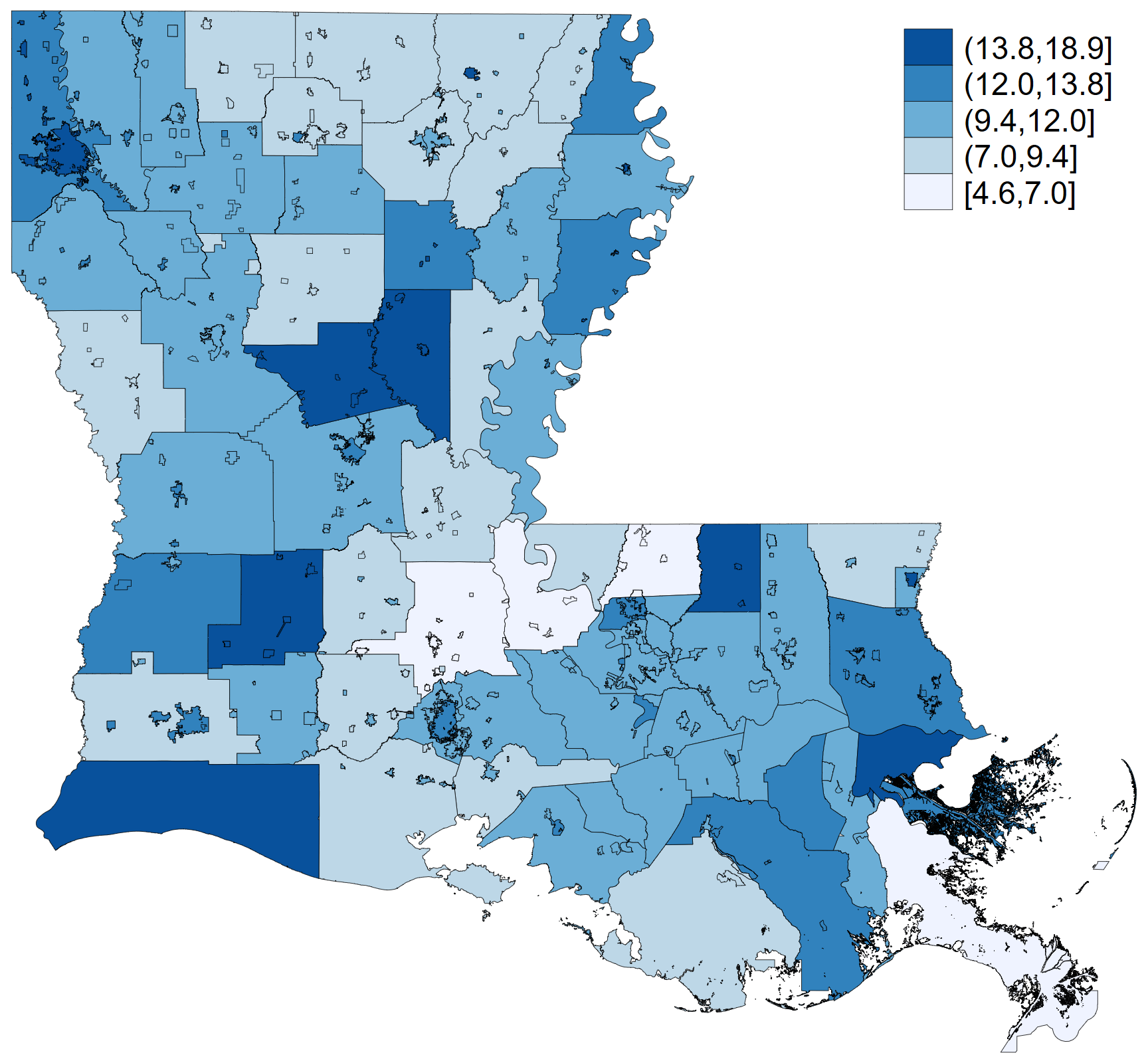

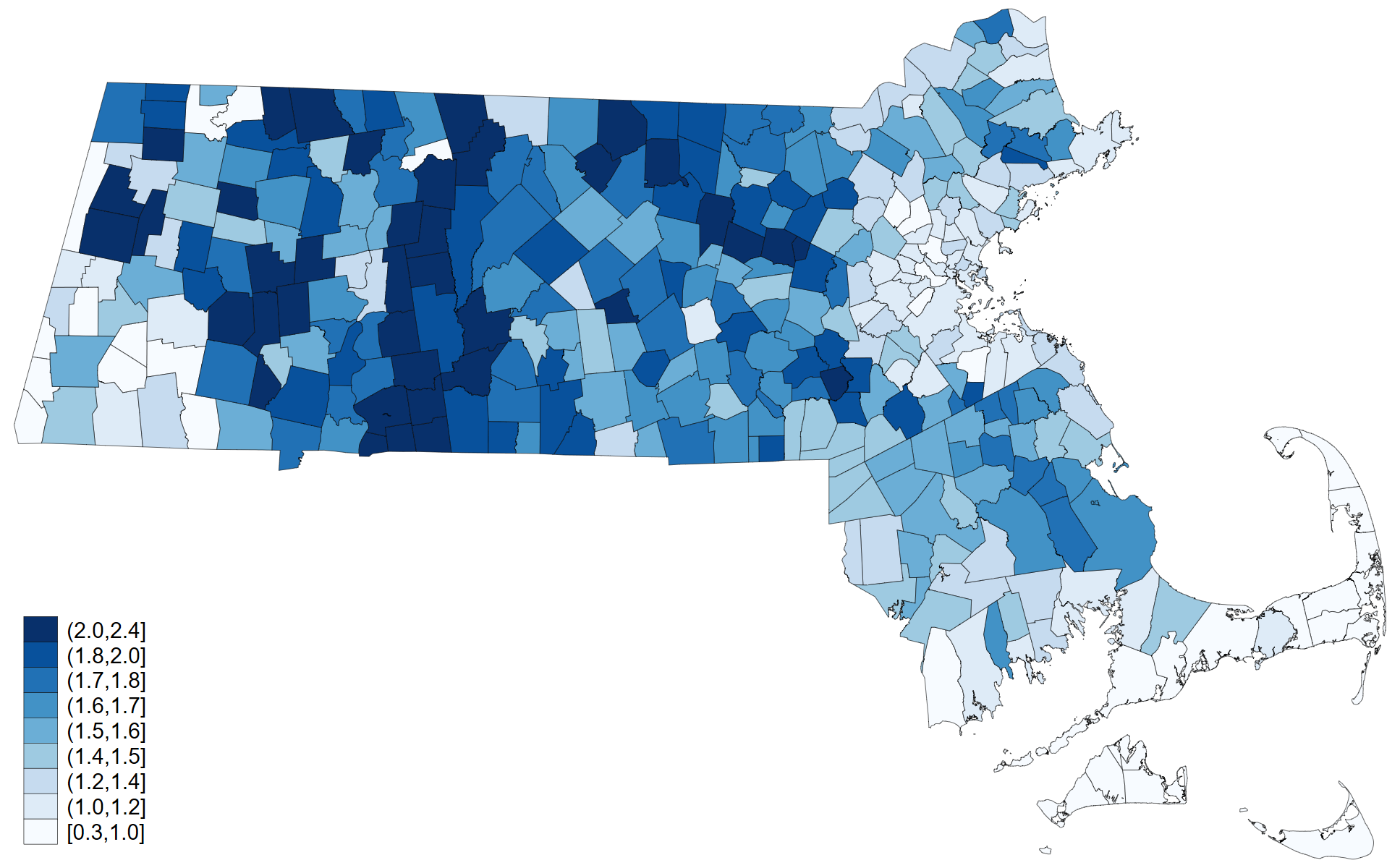

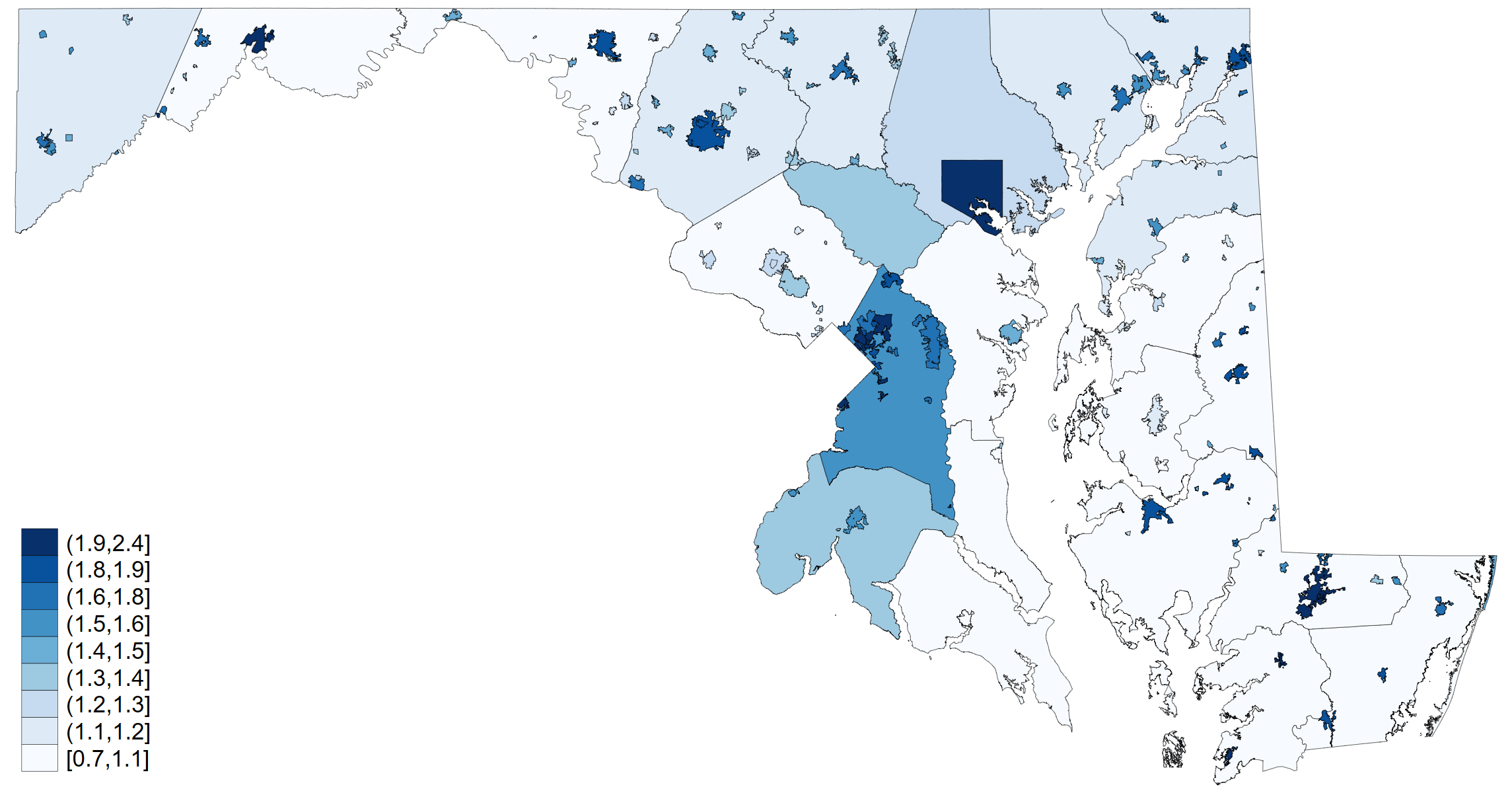

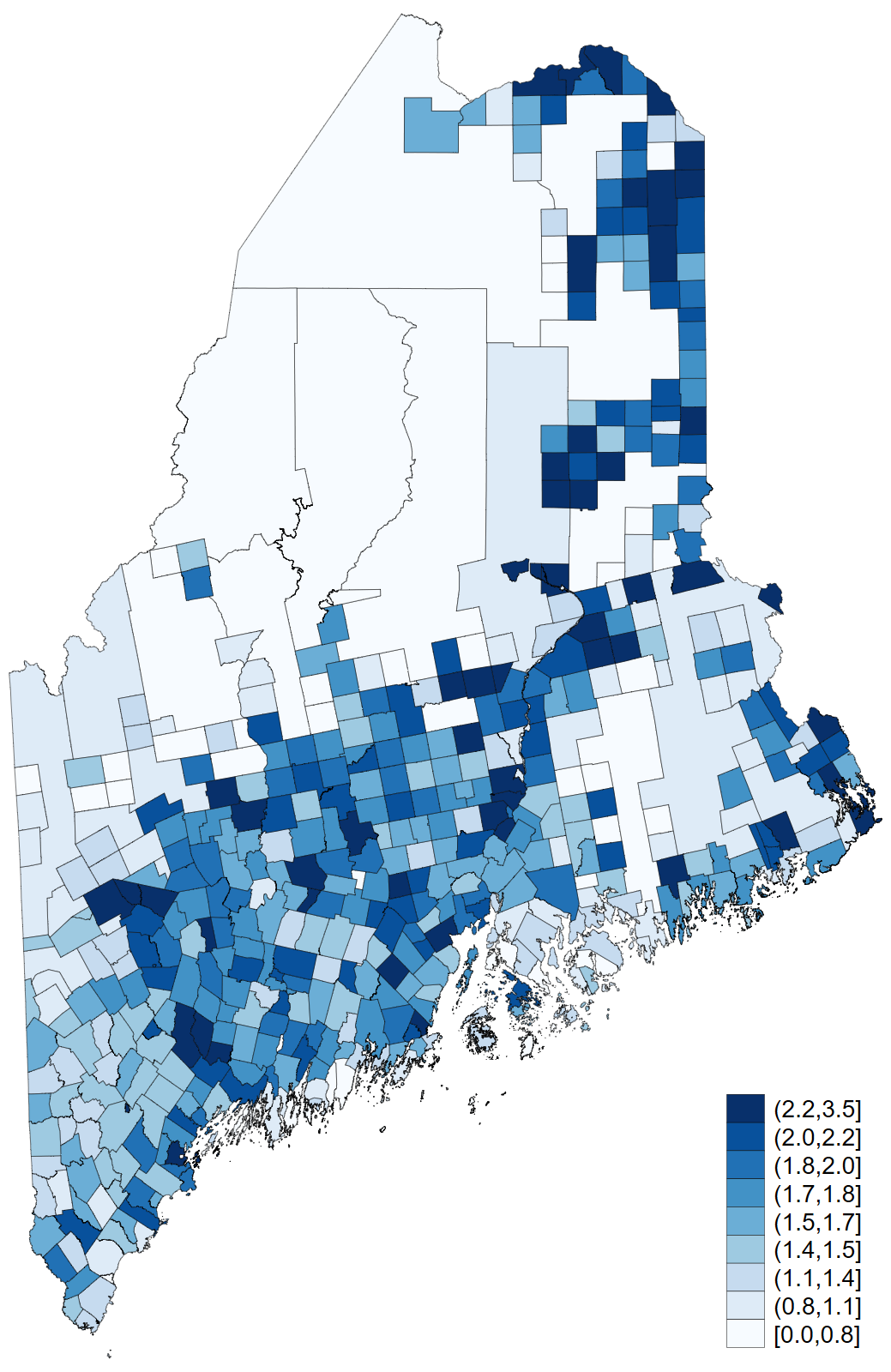

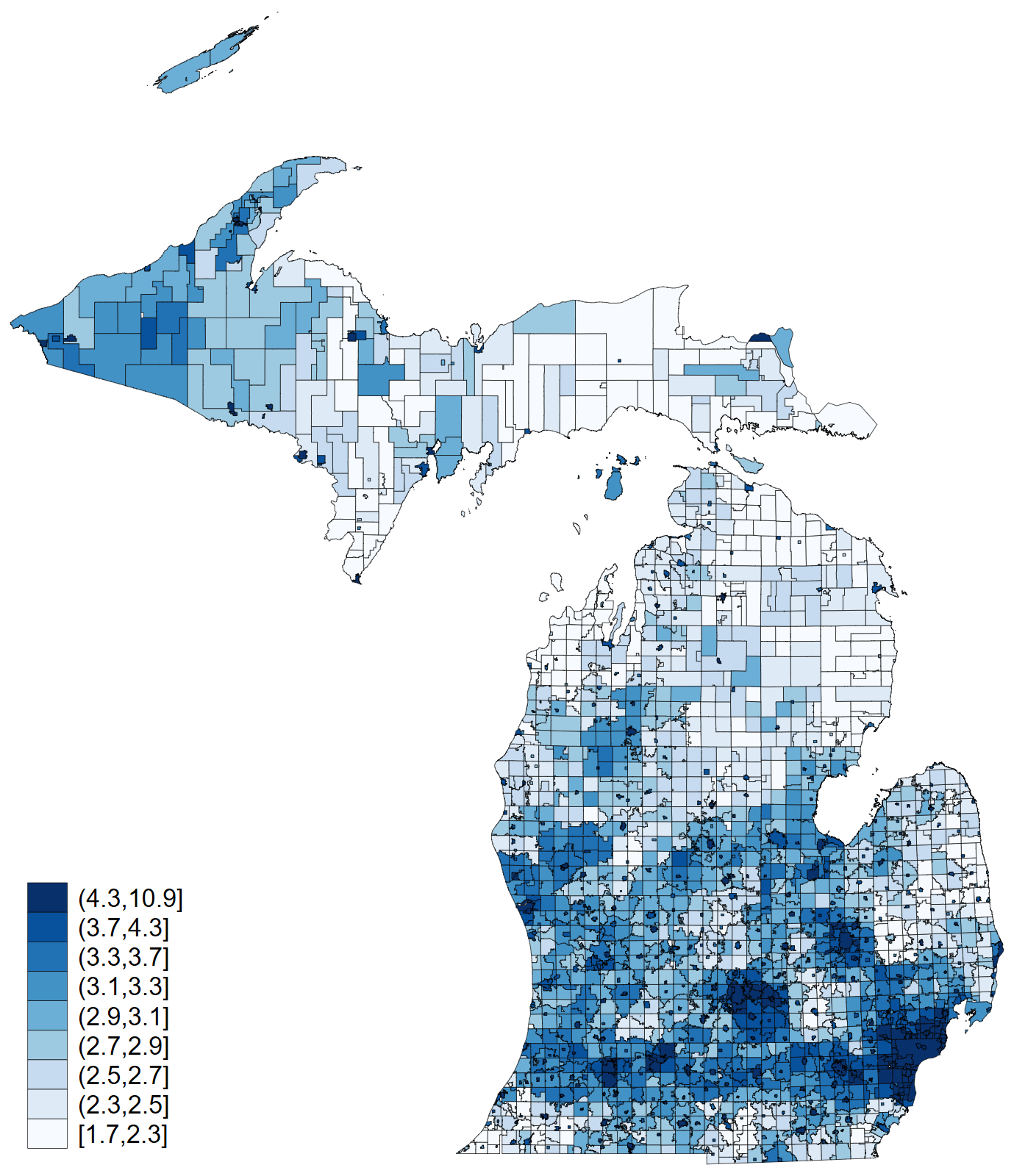

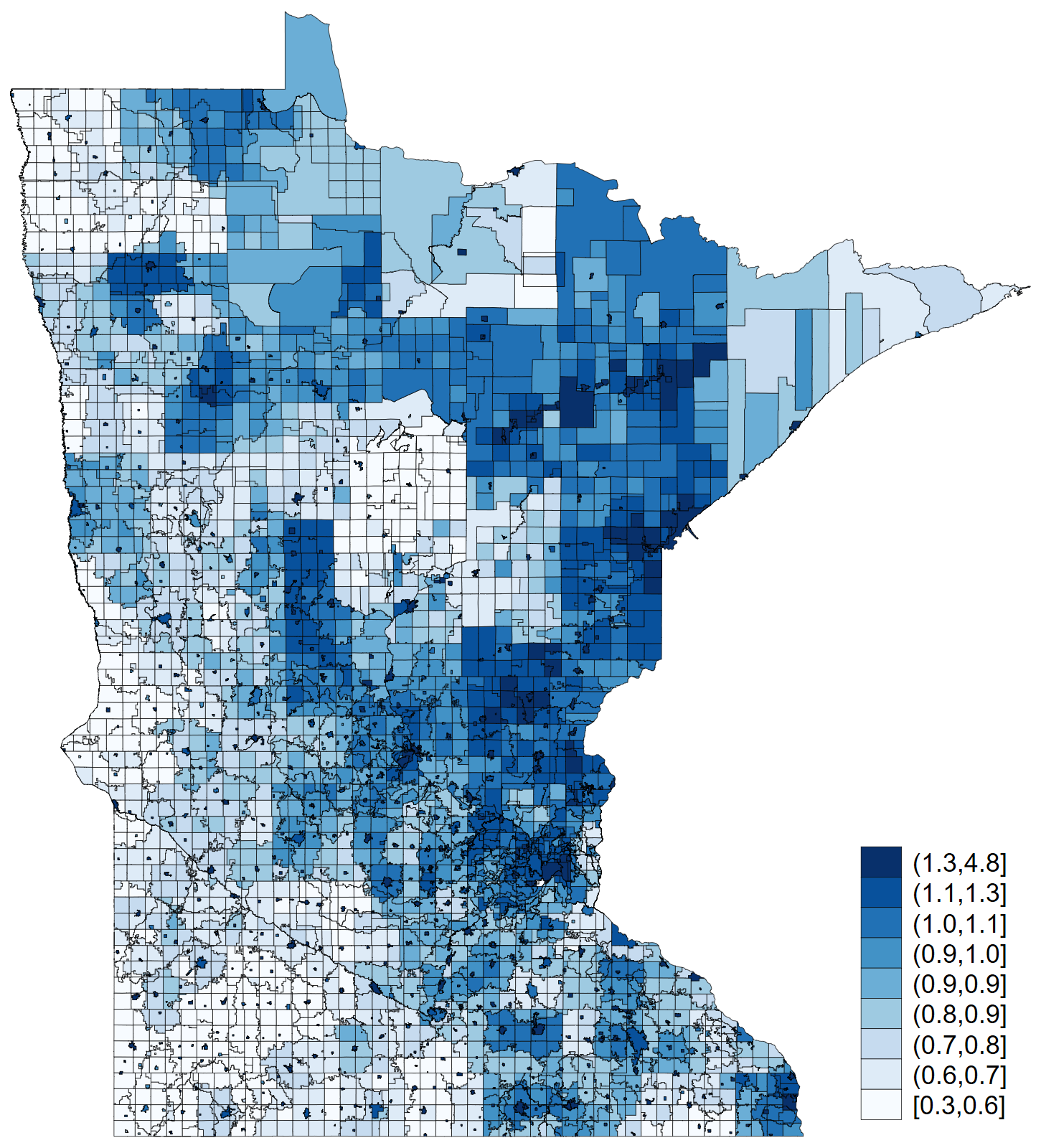

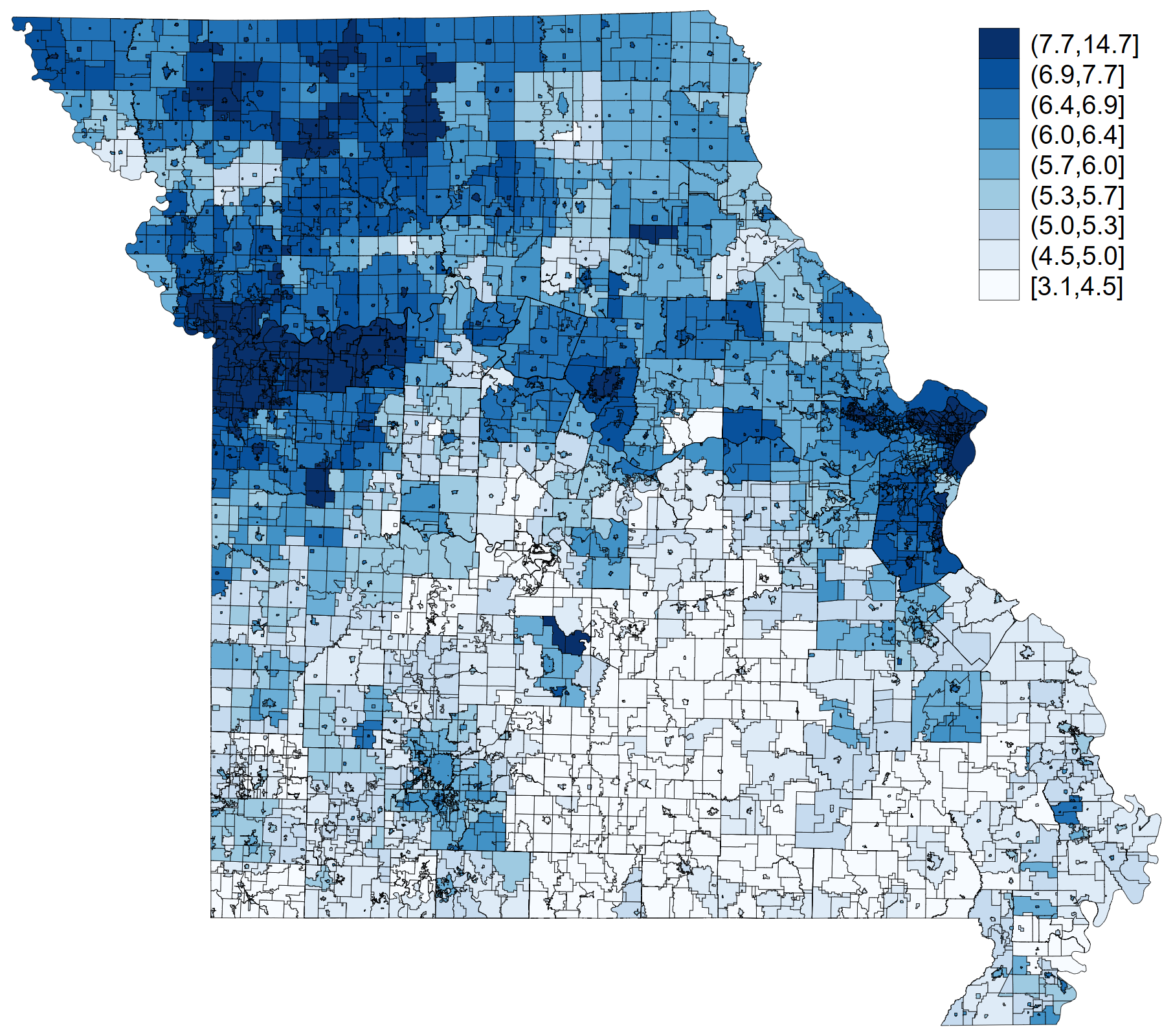

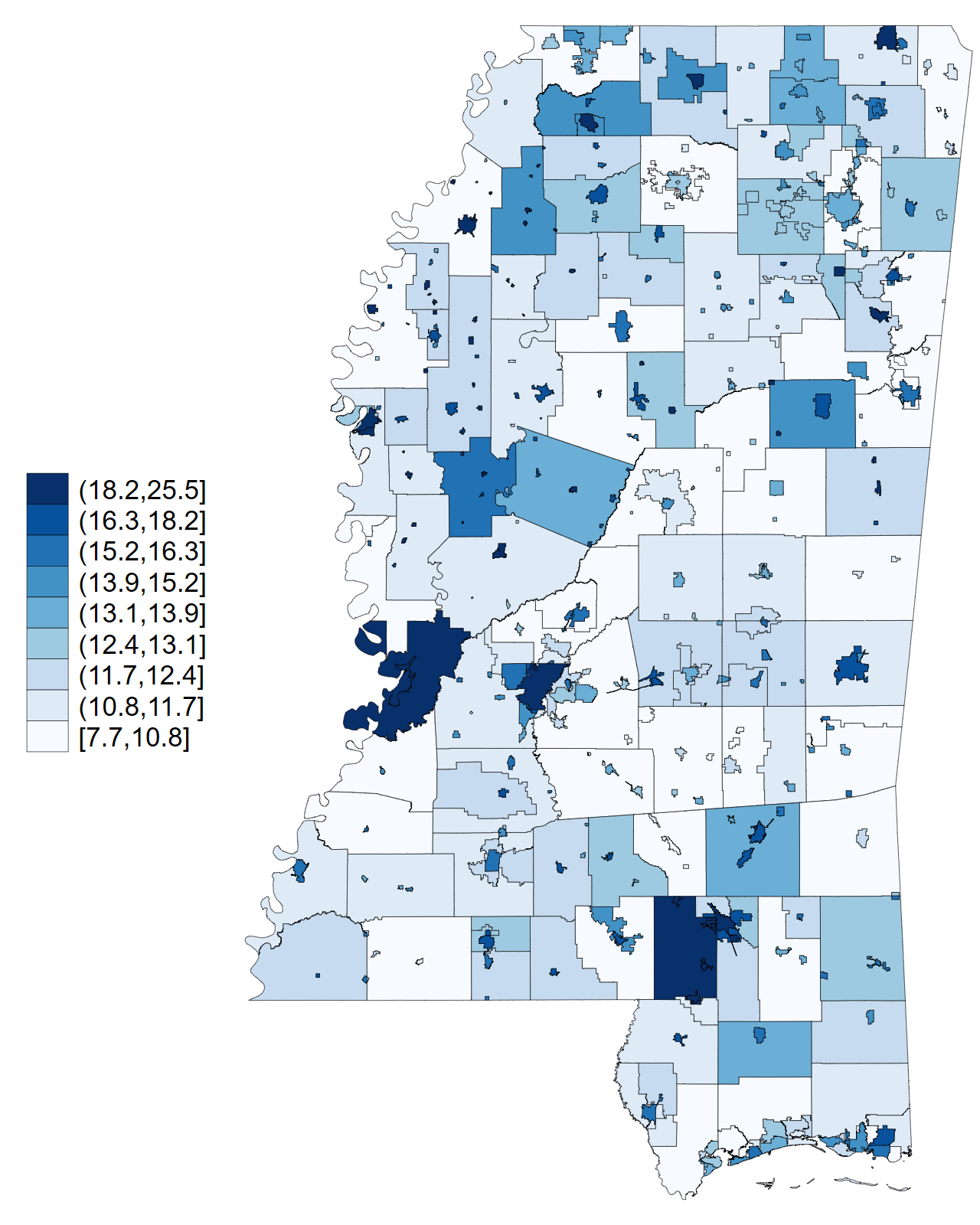

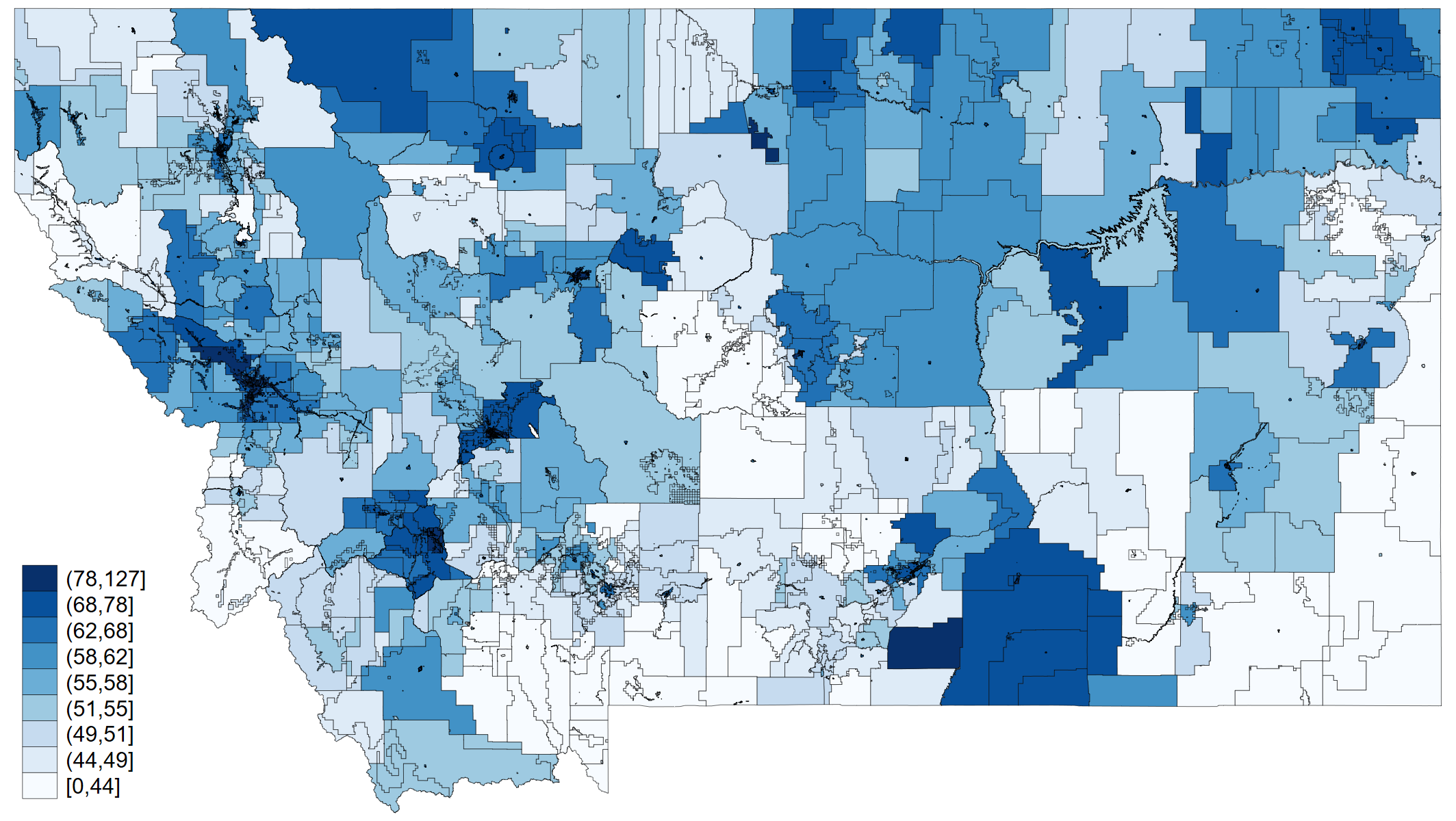

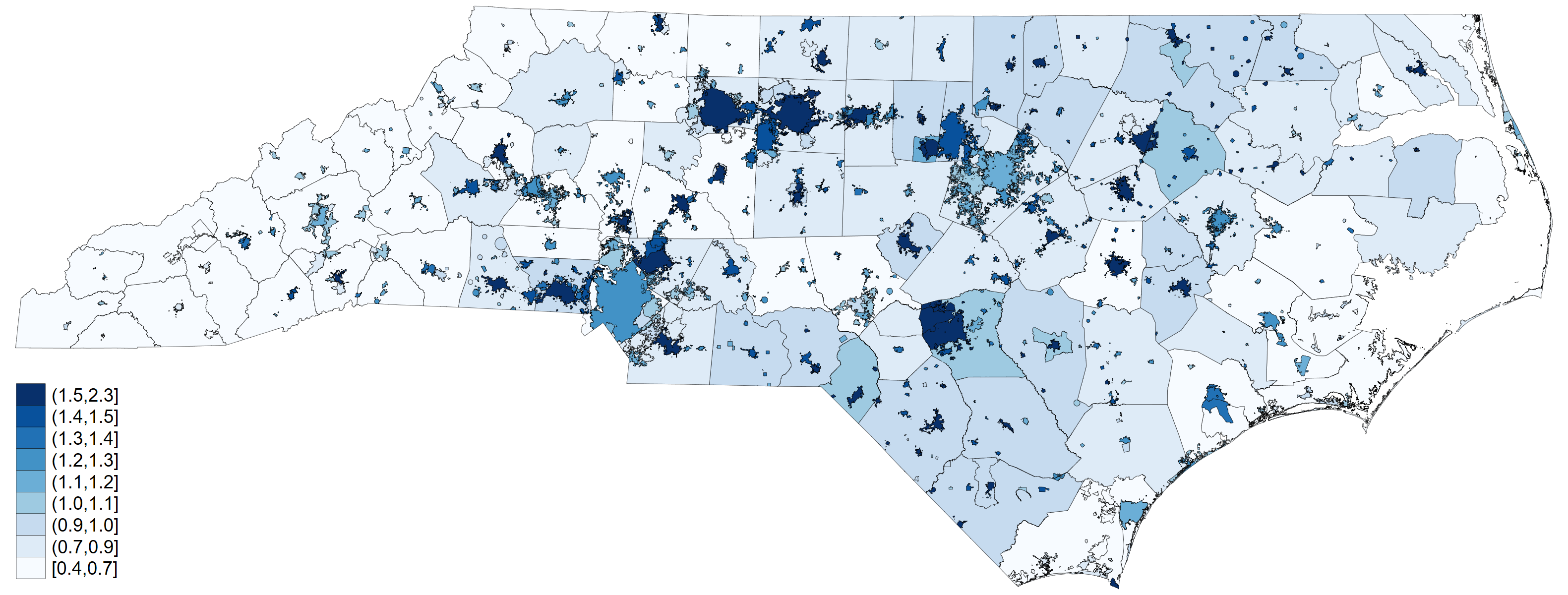

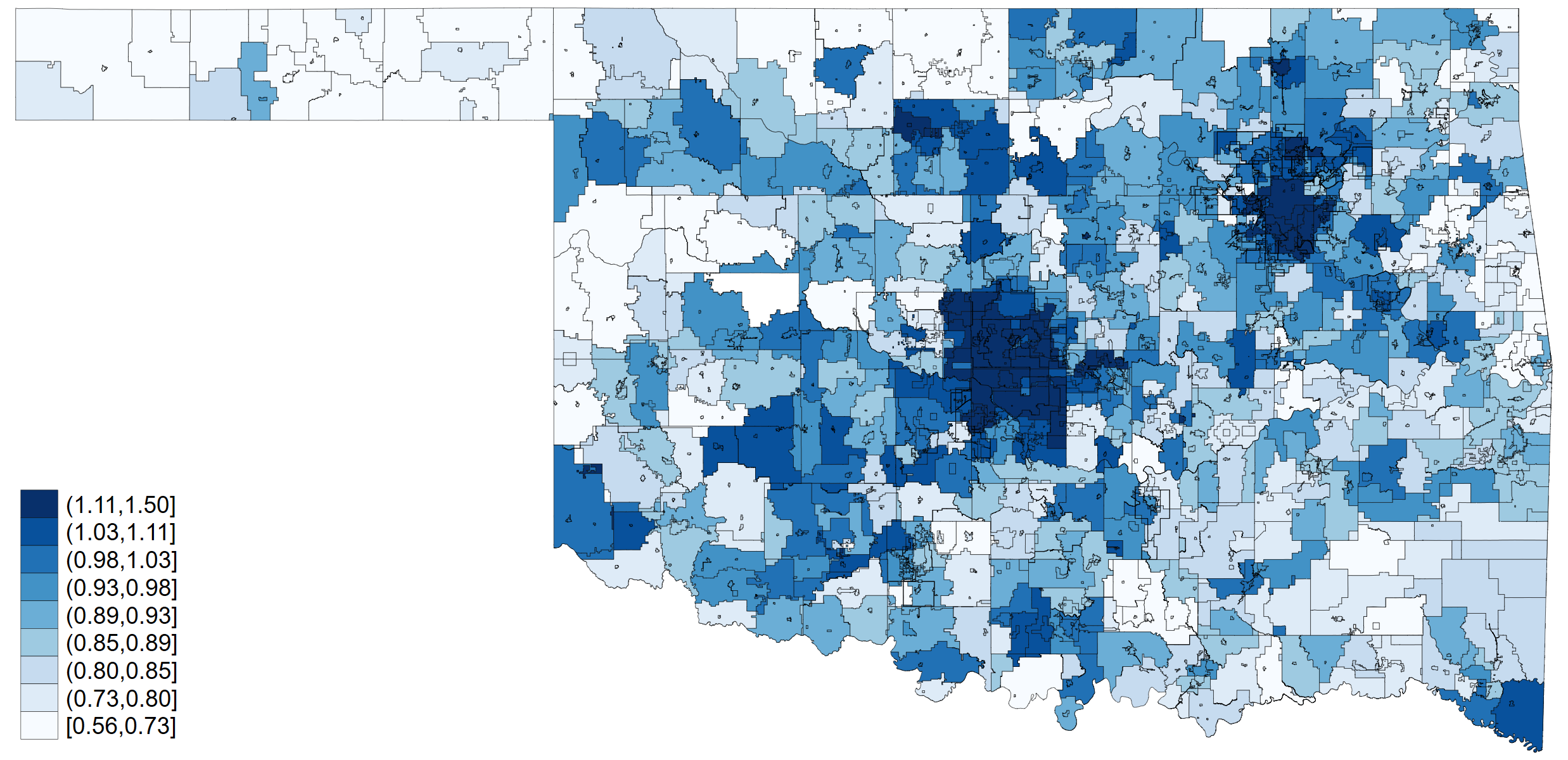

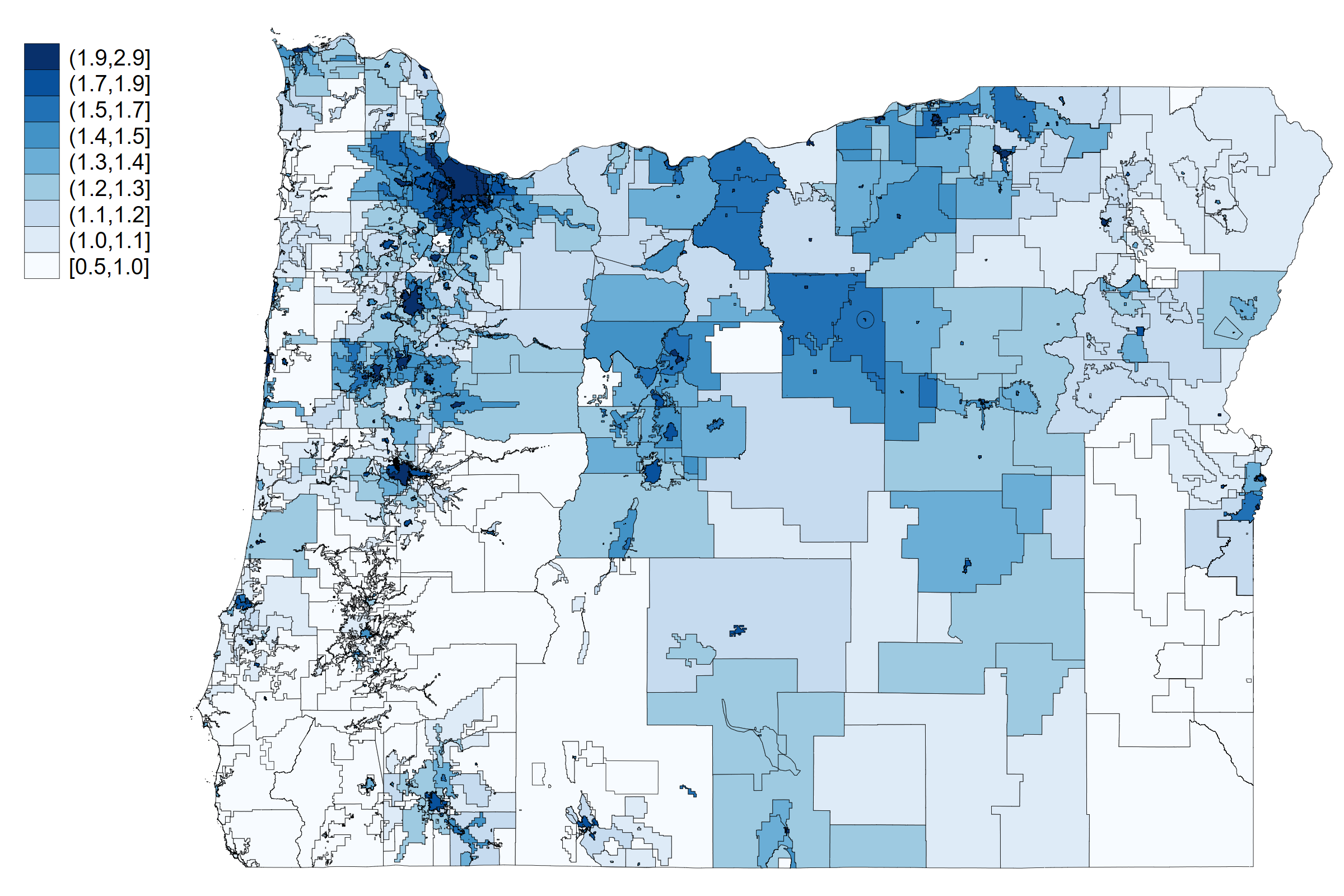

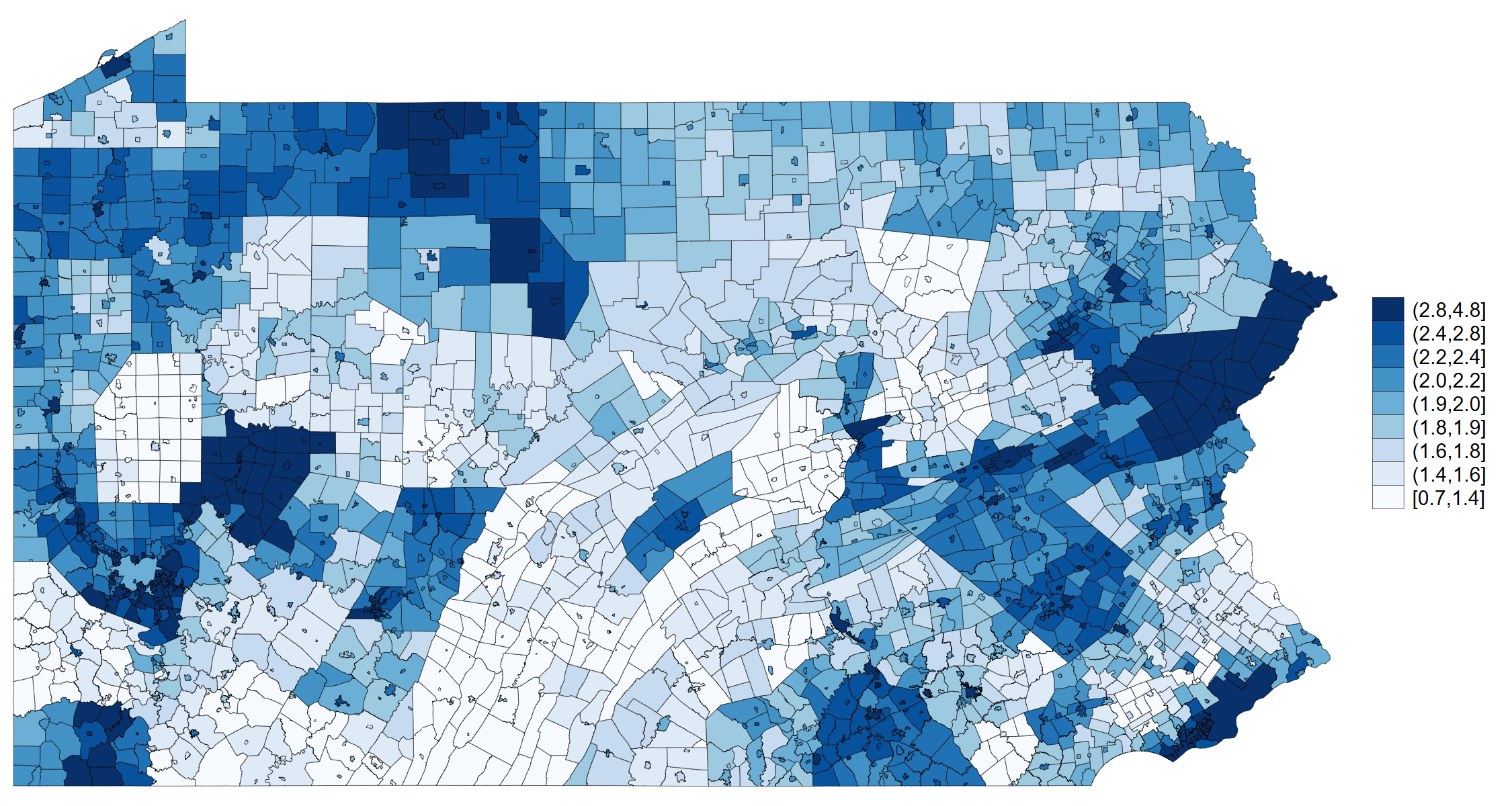

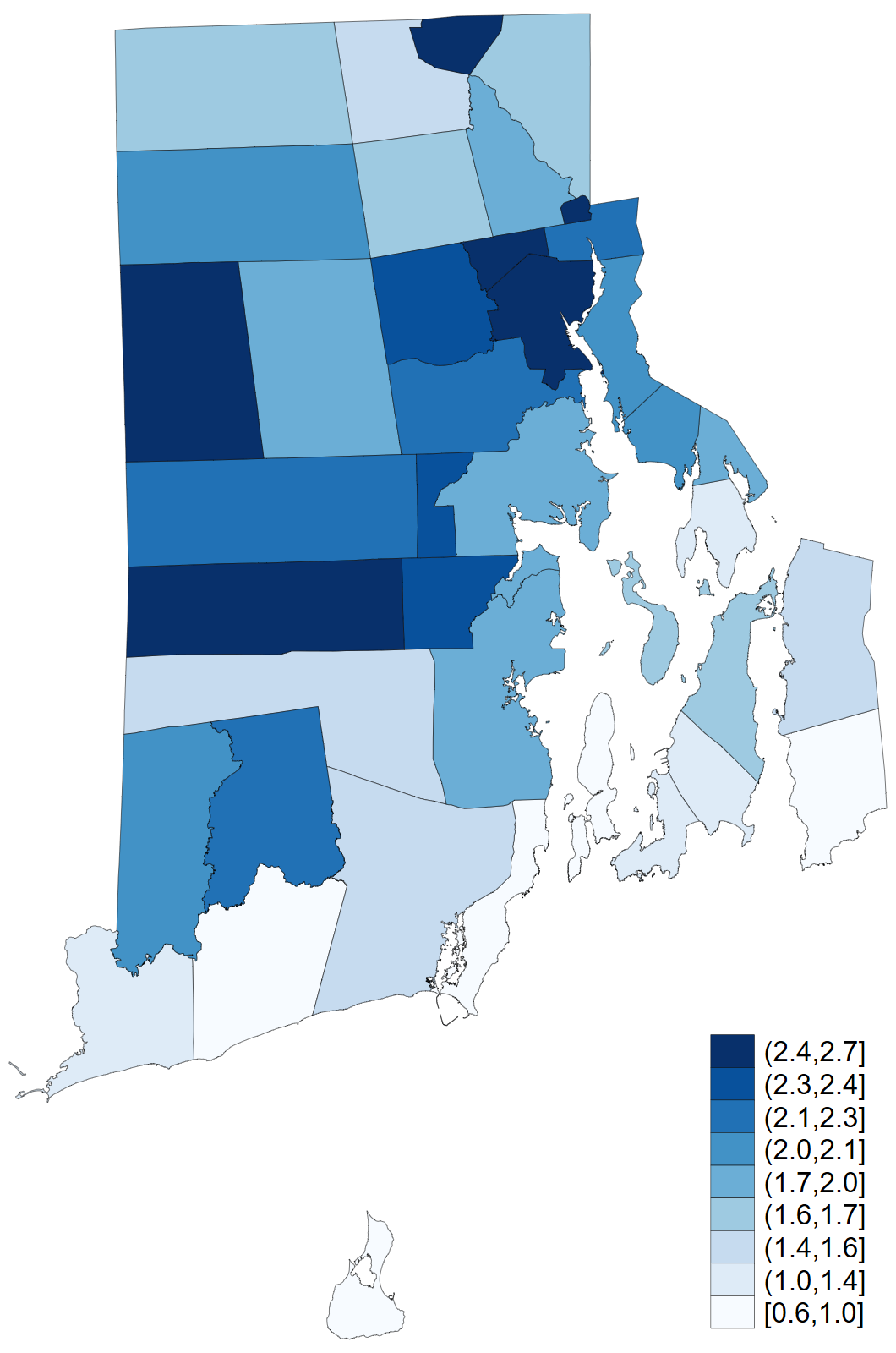

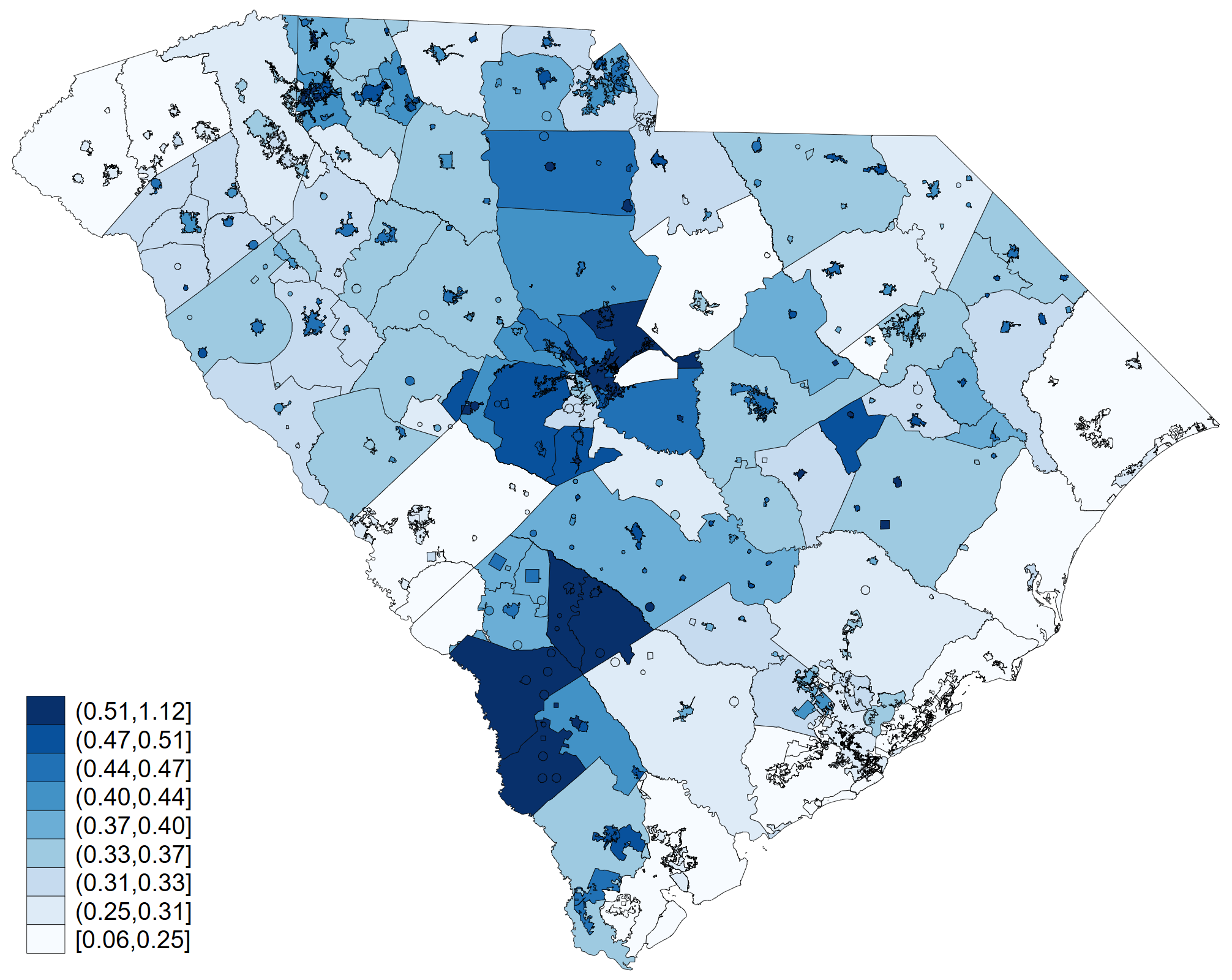

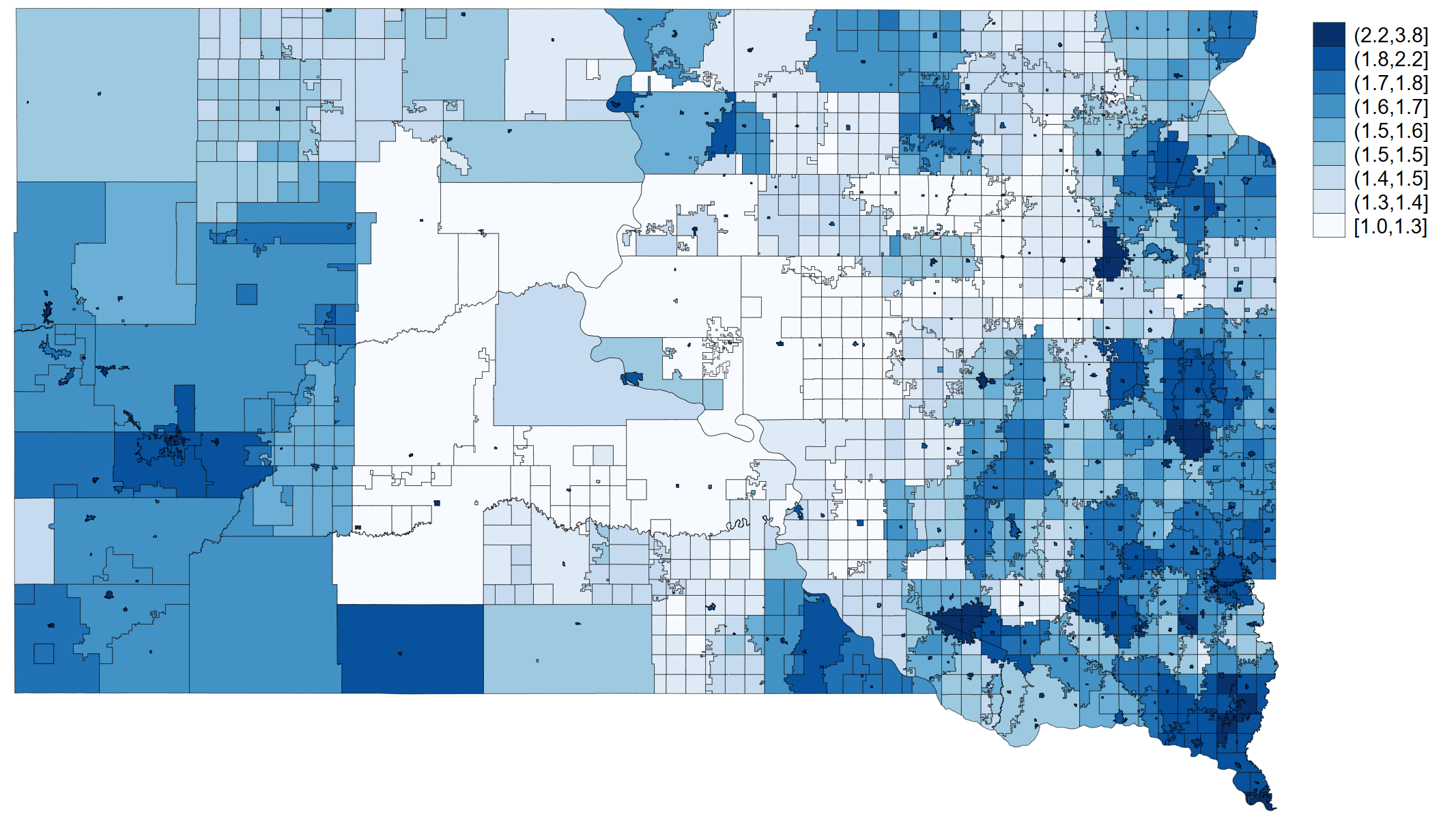

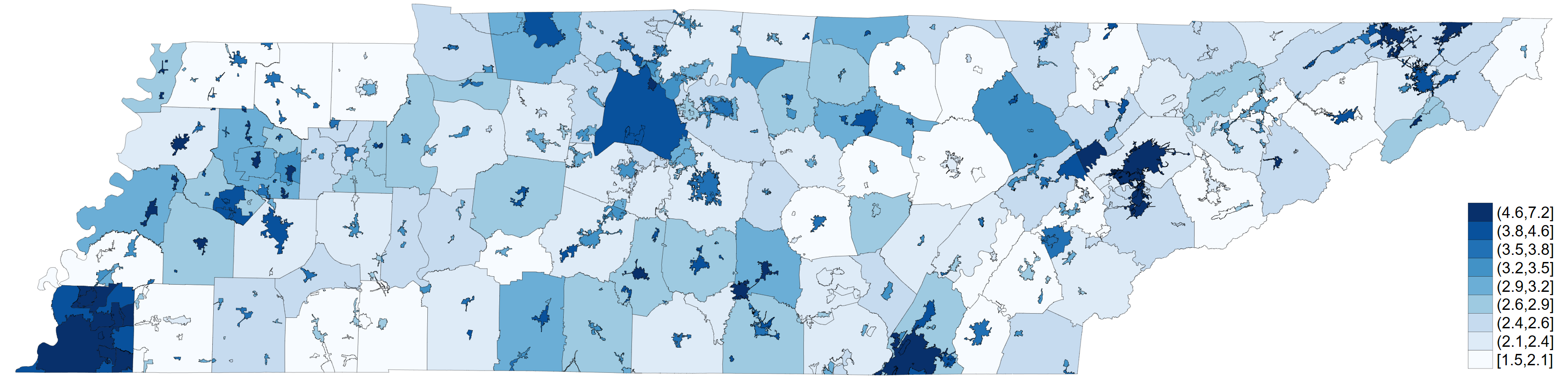

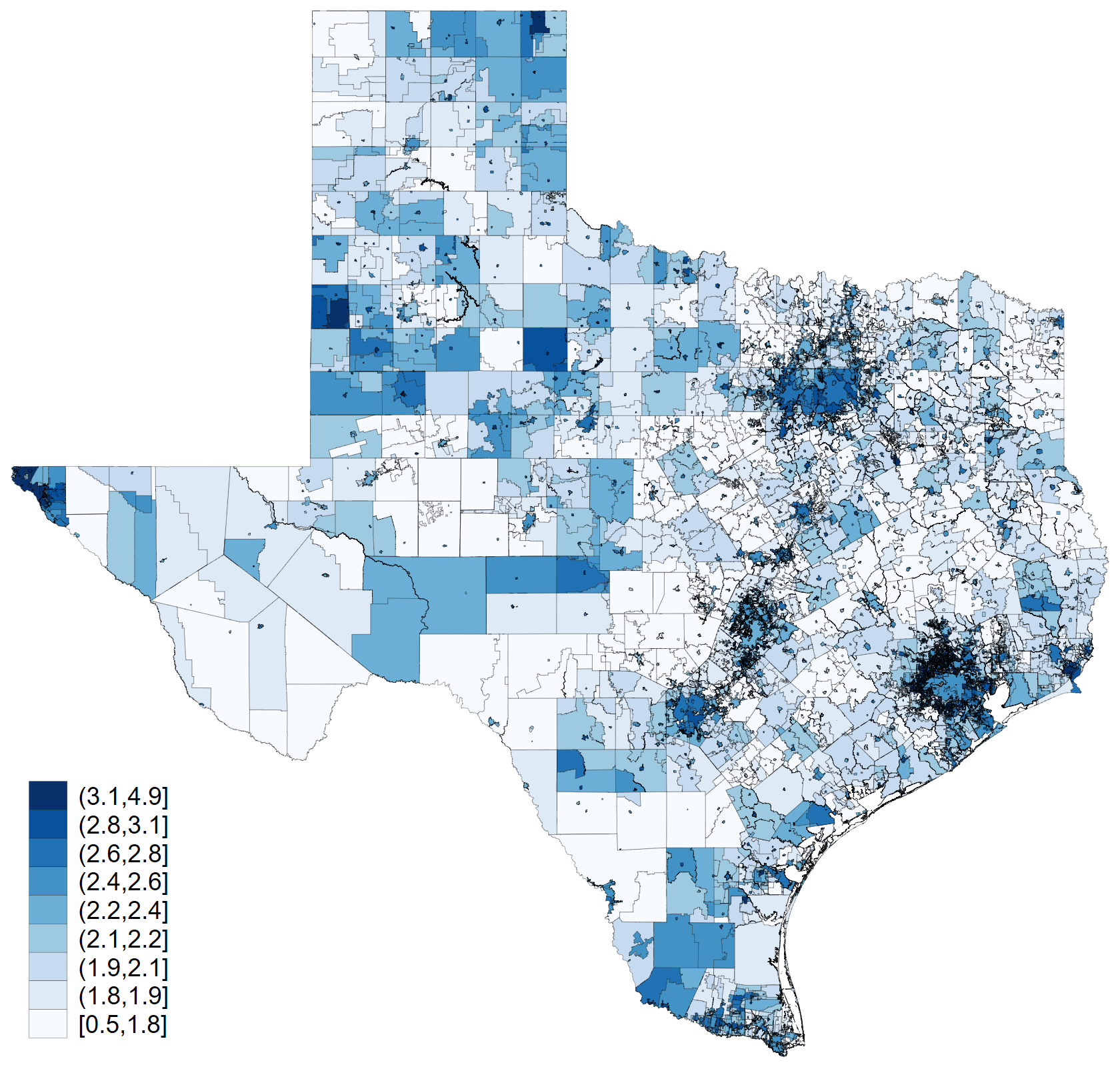

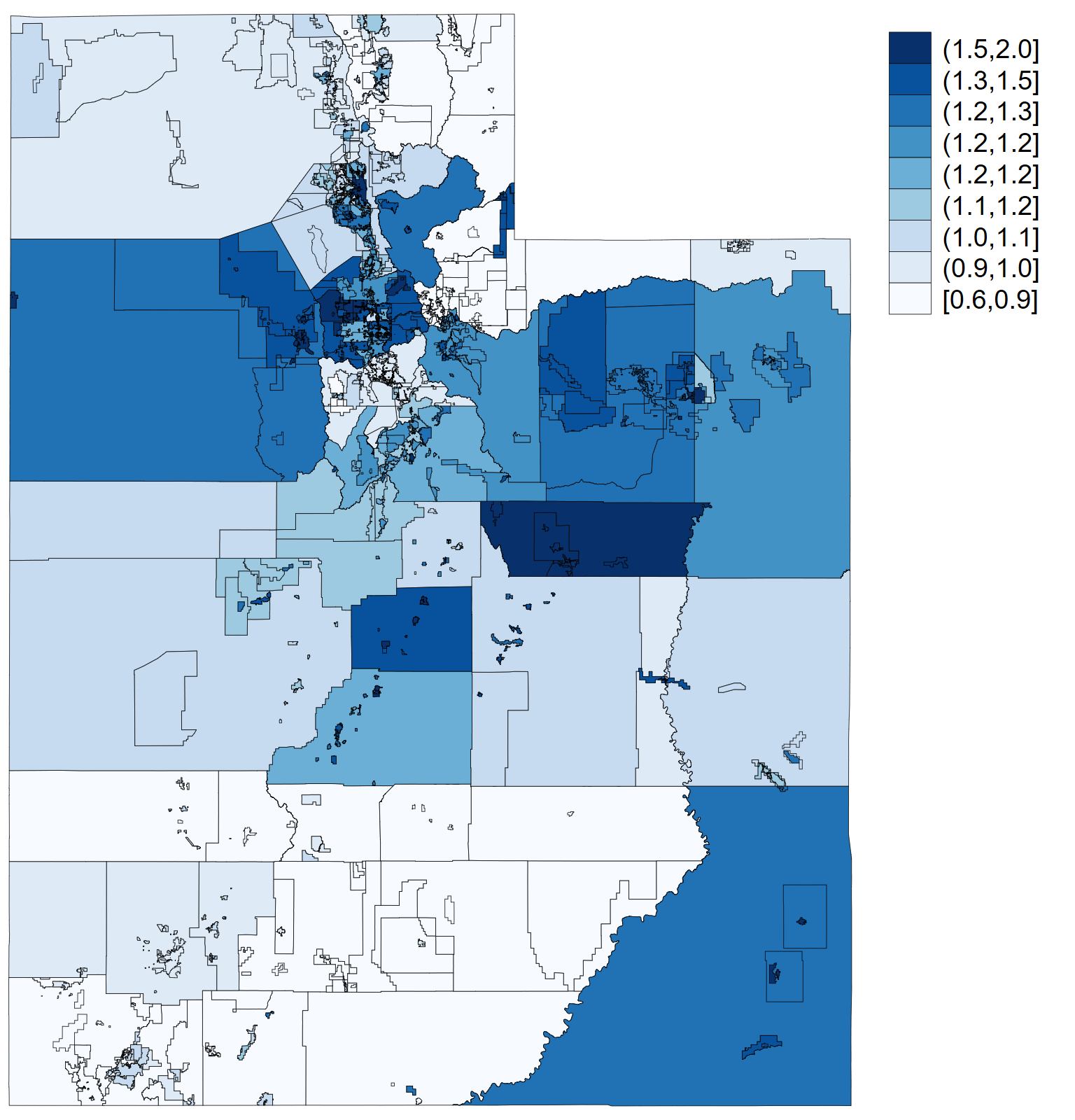

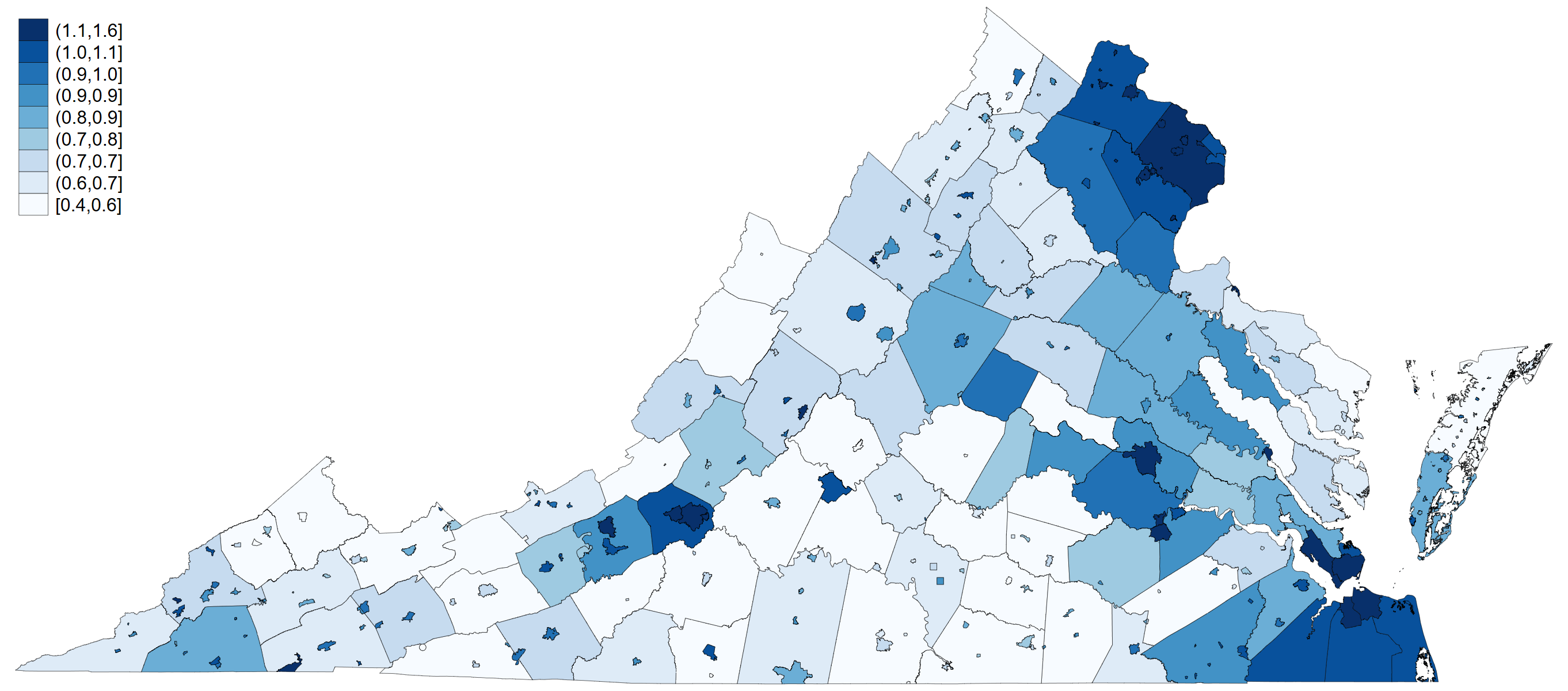

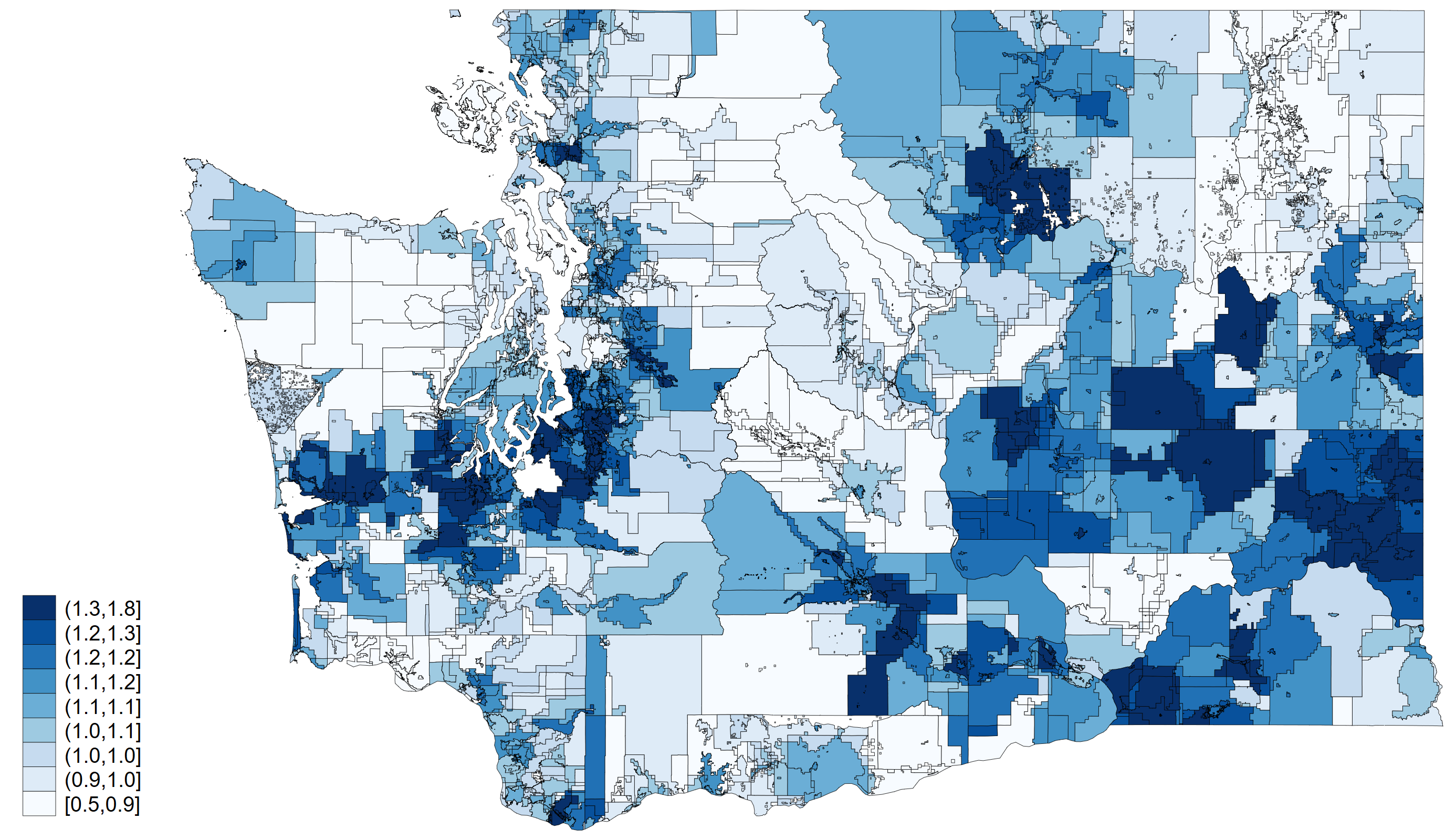

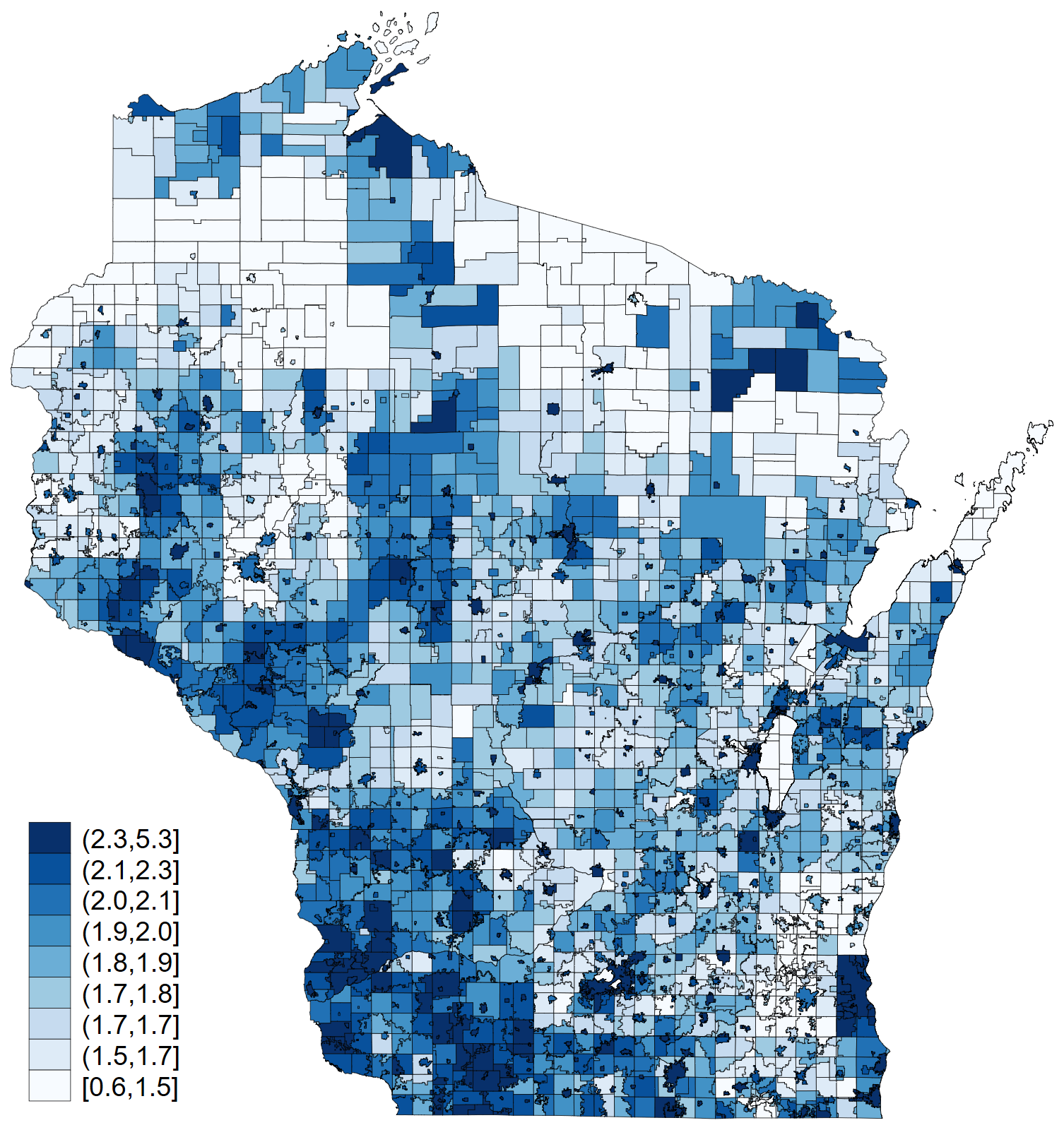

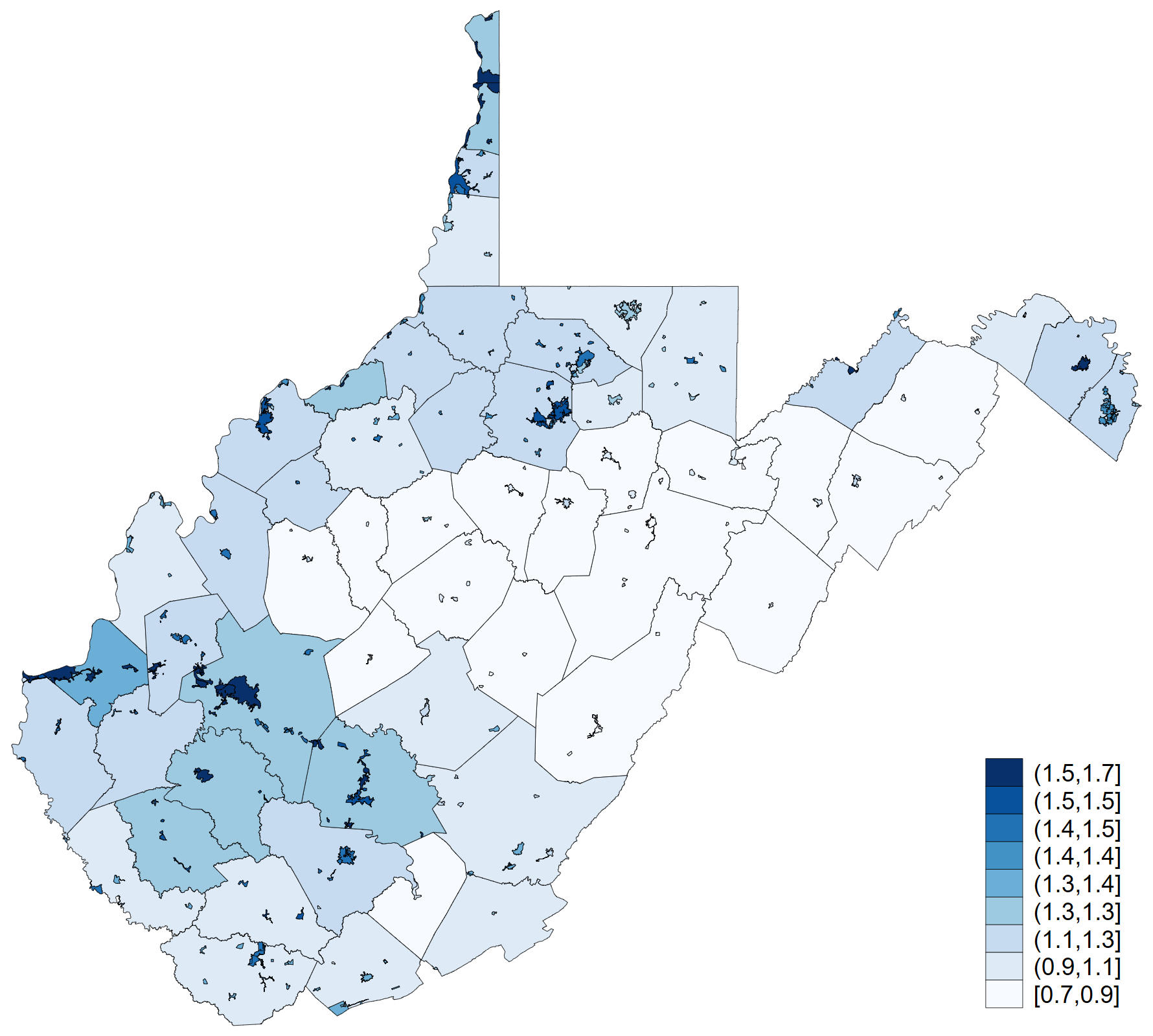

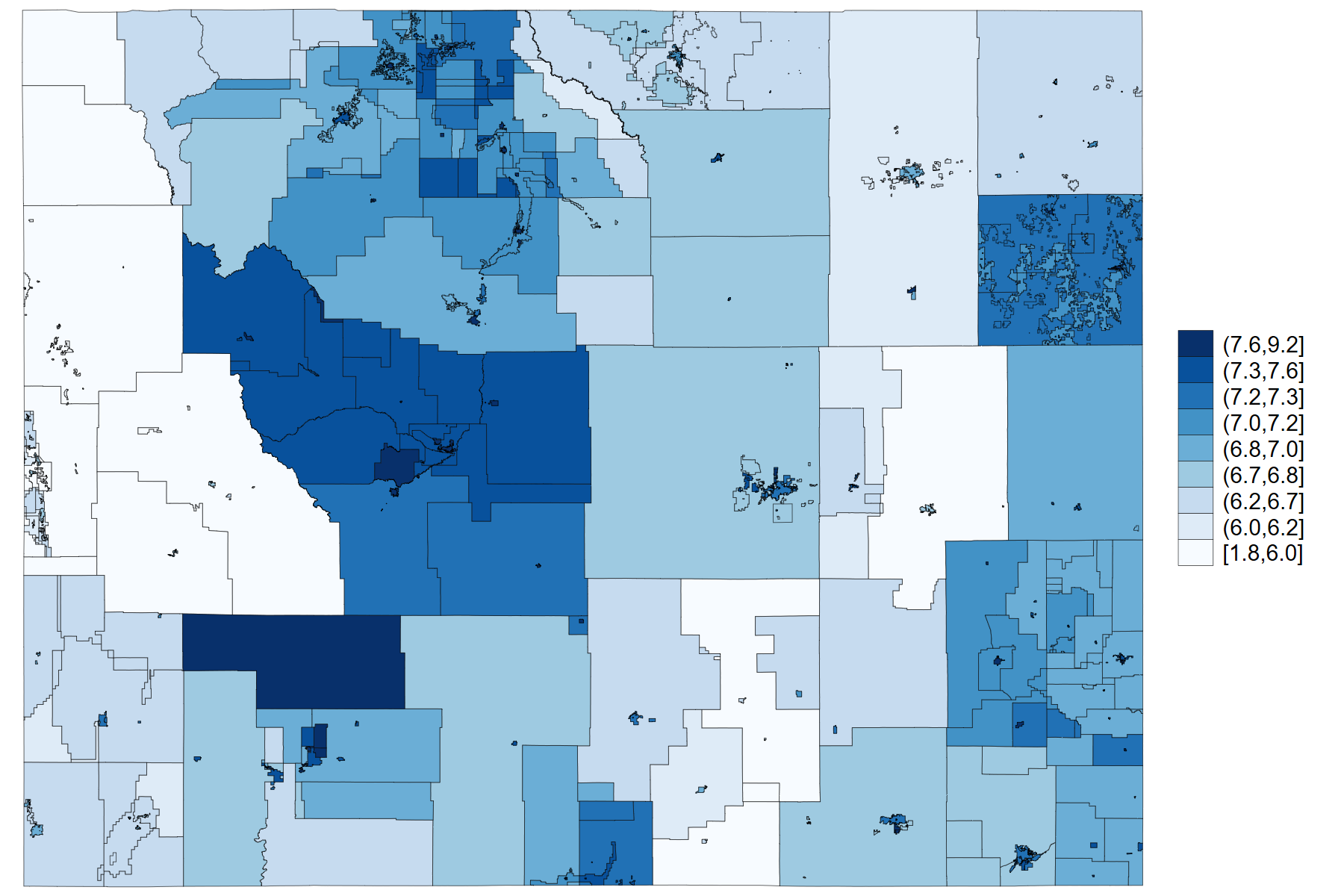

This page presents state-level maps of nominal property tax rates levied by overlapping local jurisdictions in 2020. More details on data sources are available in Appendix A of The Geography of the U.S. Property Tax.

In general, nominal rates are not directly comparable across states due to differences in the ratio of assessed to market value, the equalization of assessments across counties, and state-specific appraisal standards.

Alaska

Alaska  Alabama

Alabama  Arkansas

Arkansas  Arizona

Arizona  California

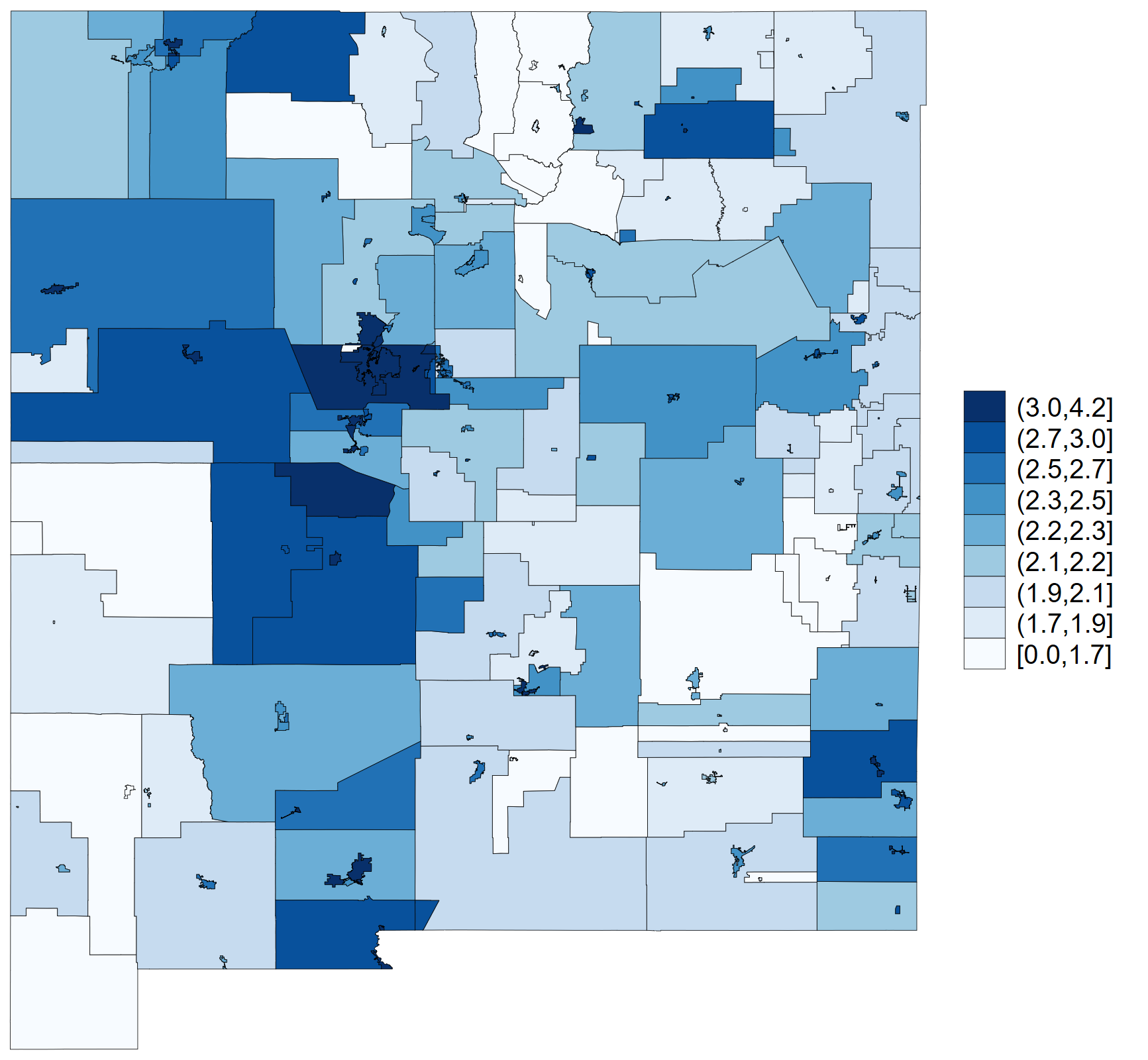

California  Colorado

Colorado  Connecticut

Connecticut  District of Columbia

District of Columbia  Delaware

Delaware  Florida

Florida  Georgia

Georgia  Hawaii

Hawaii  Iowa

Iowa  Idaho

Idaho  Illinois

Illinois  Indiana

Indiana  Kansas

Kansas  Kentucky

Kentucky  Louisiana

Louisiana  Massachusetts

Massachusetts  Maryland

Maryland  Maine

Maine  Michigan

Michigan  Minnesota

Minnesota  Missouri

Missouri  Mississippi

Mississippi  Montana

Montana  North Carolina

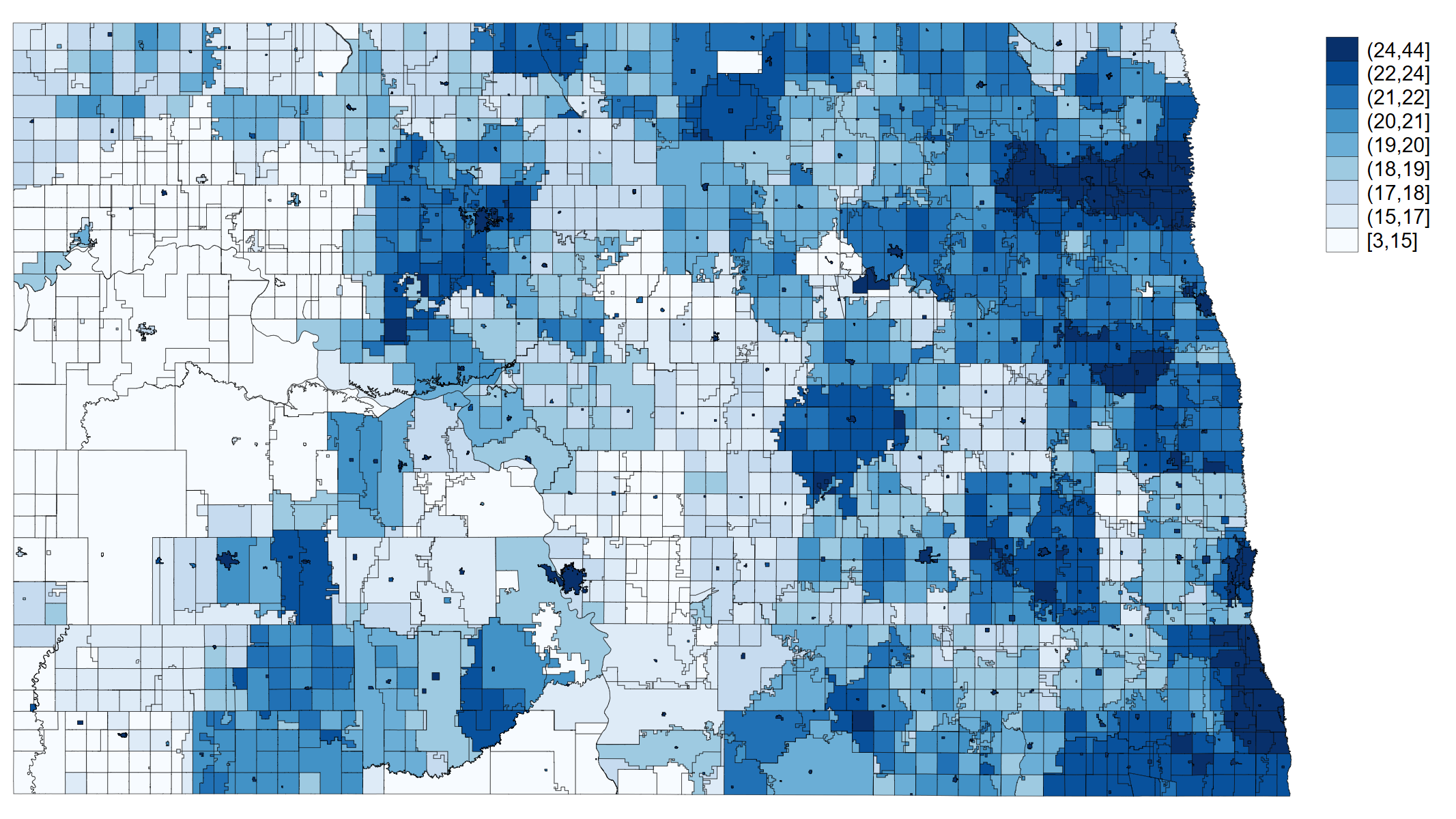

North Carolina  North Dakota

North Dakota  Nebraska

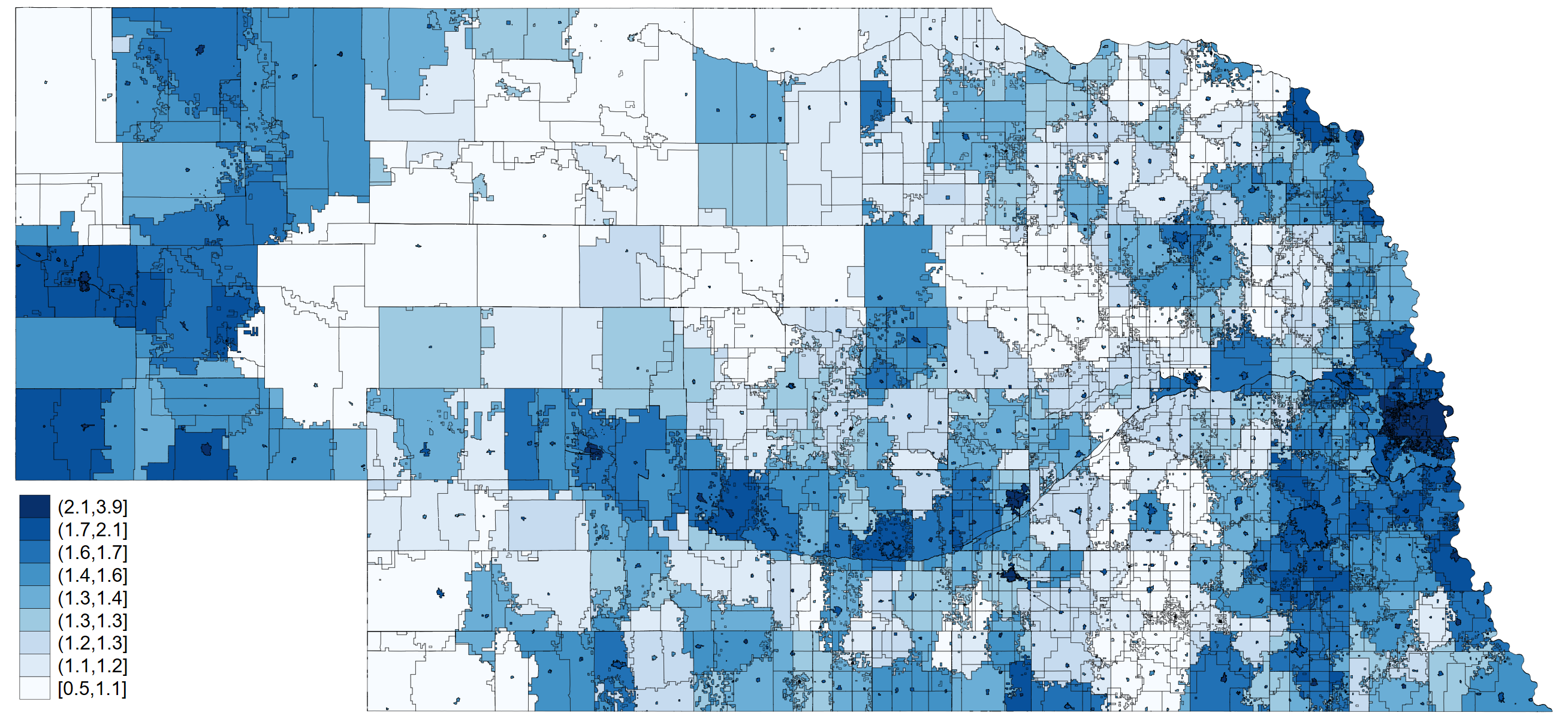

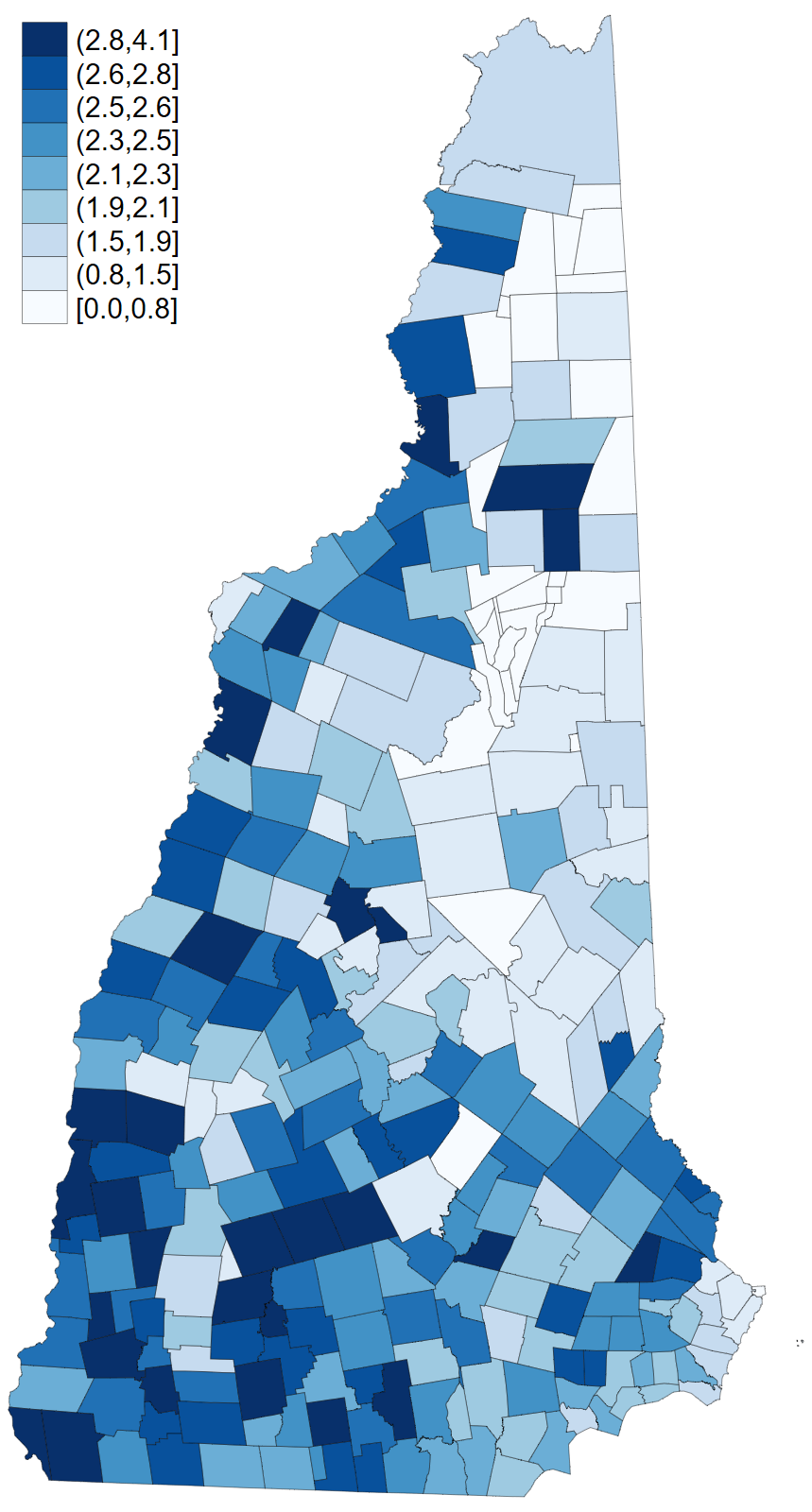

Nebraska  New Hampshire

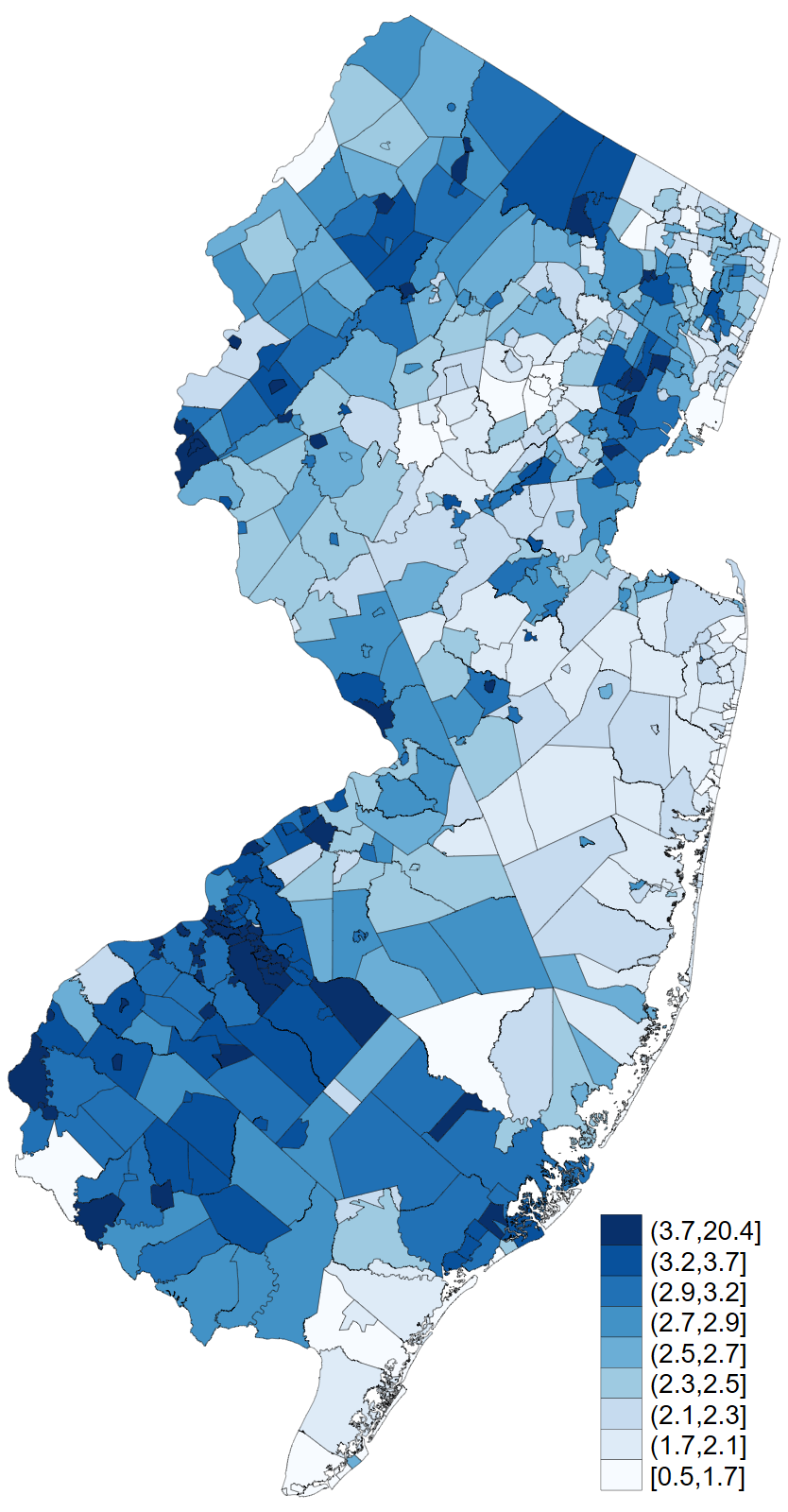

New Hampshire  New Jersey

New Jersey  New Mexico

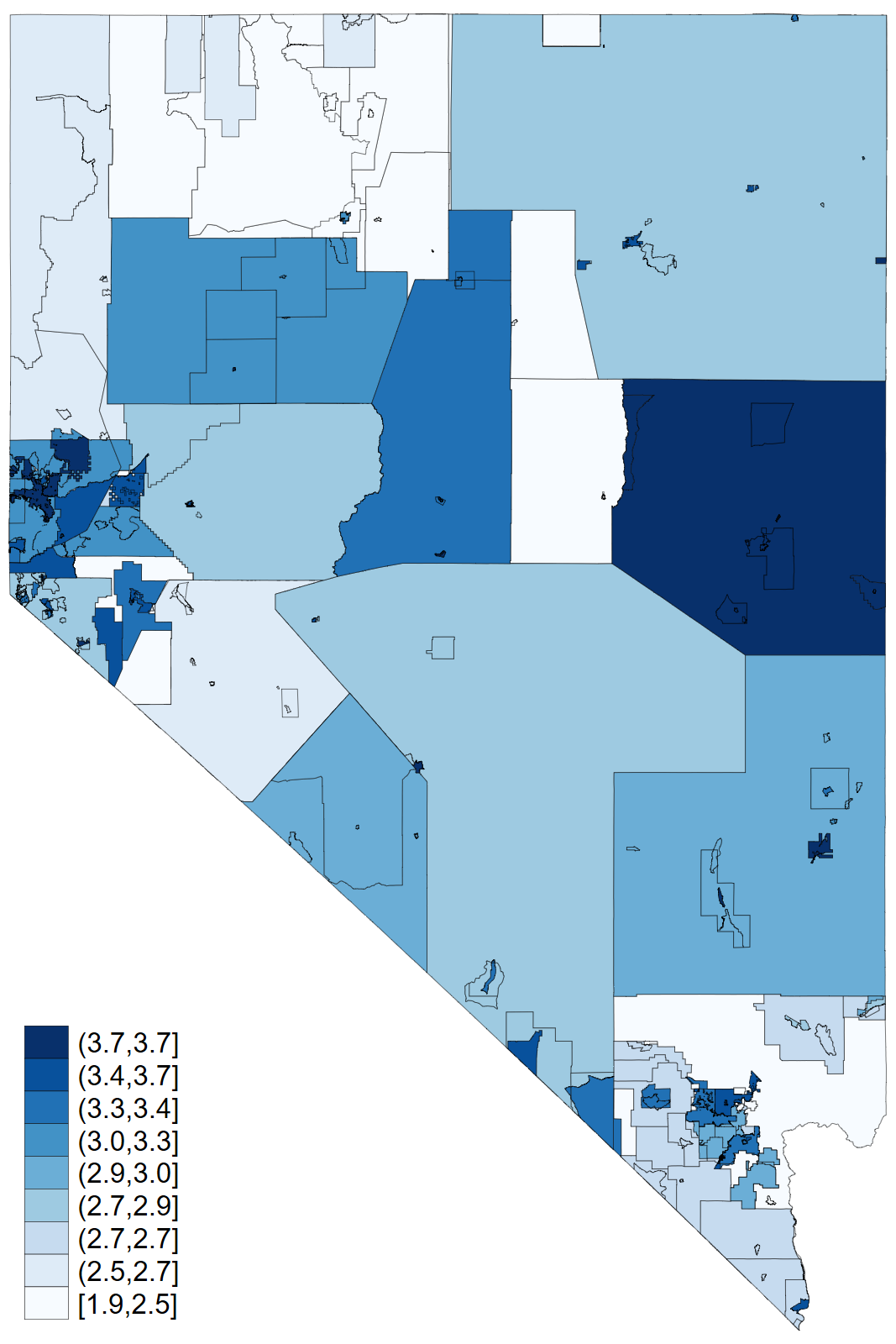

New Mexico  Nevada

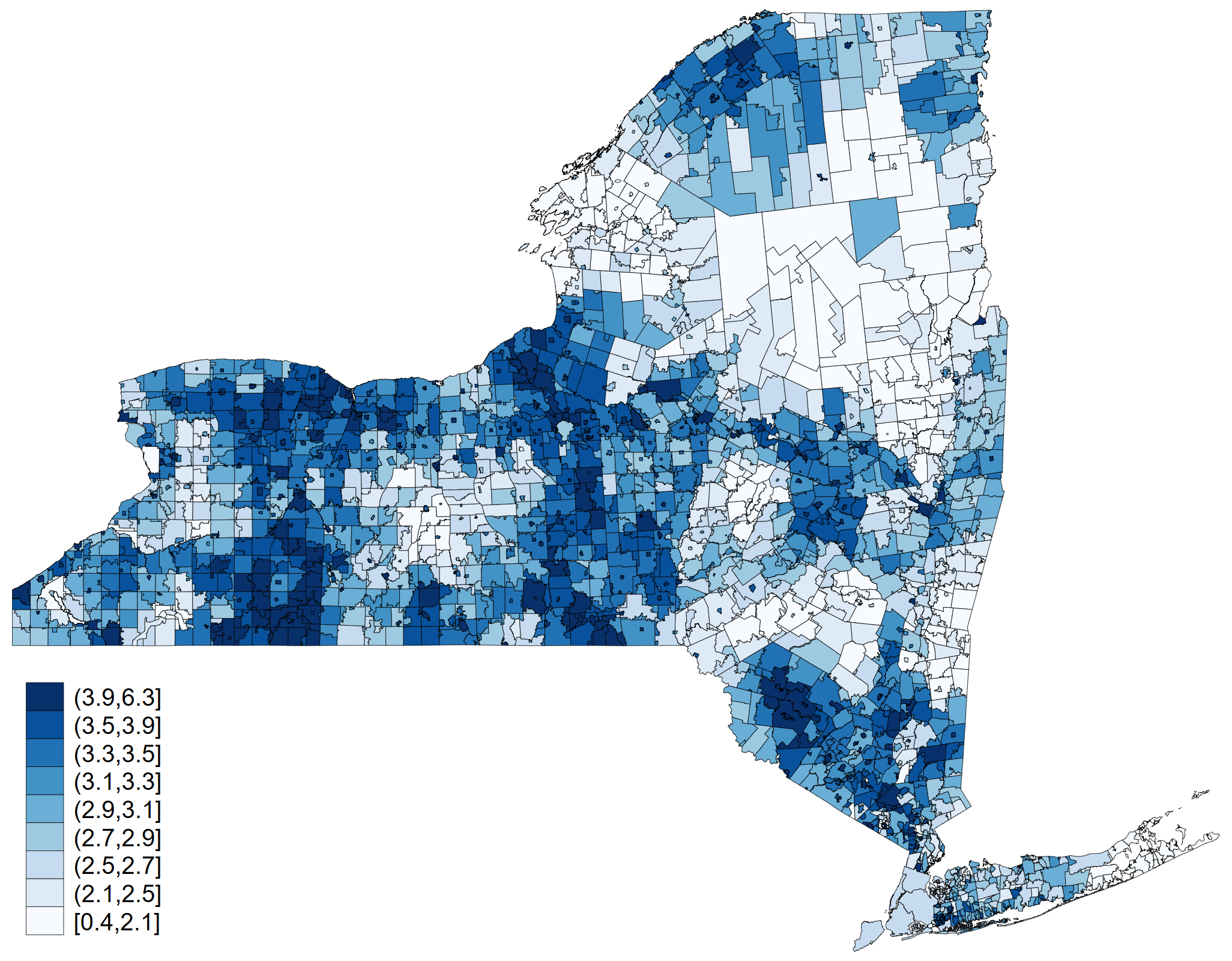

Nevada  New York

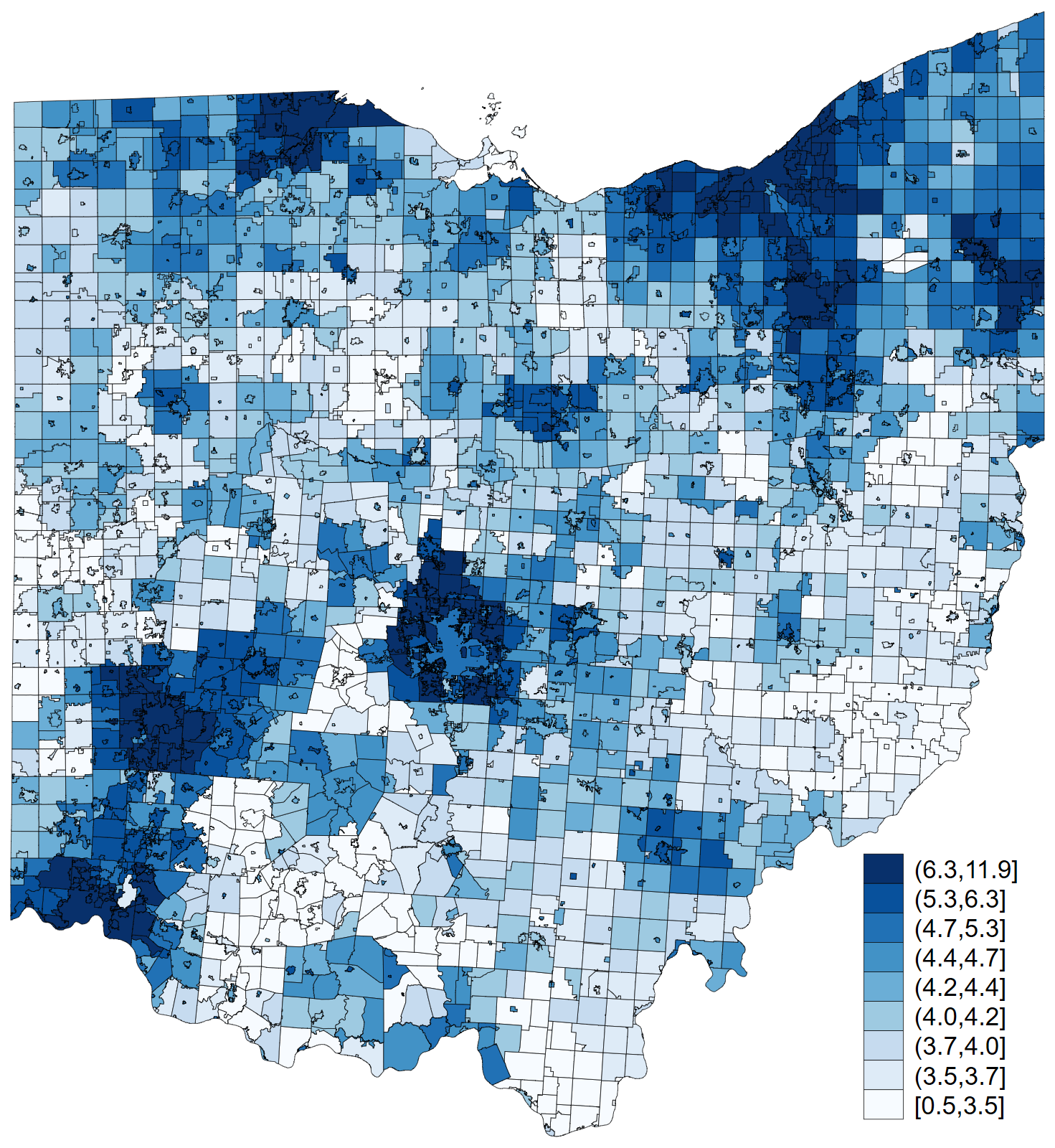

New York  Ohio

Ohio  Oklahoma

Oklahoma  Oregon

Oregon  Pennsylvania

Pennsylvania  Rhode Island

Rhode Island  South Carolina

South Carolina  South Dakota

South Dakota  Tennessee

Tennessee  Texas

Texas  Utah

Utah  Virginia

Virginia  Vermont

Vermont  Washington

Washington  Wisconsin

Wisconsin  West Virginia

West Virginia  Wyoming

Wyoming